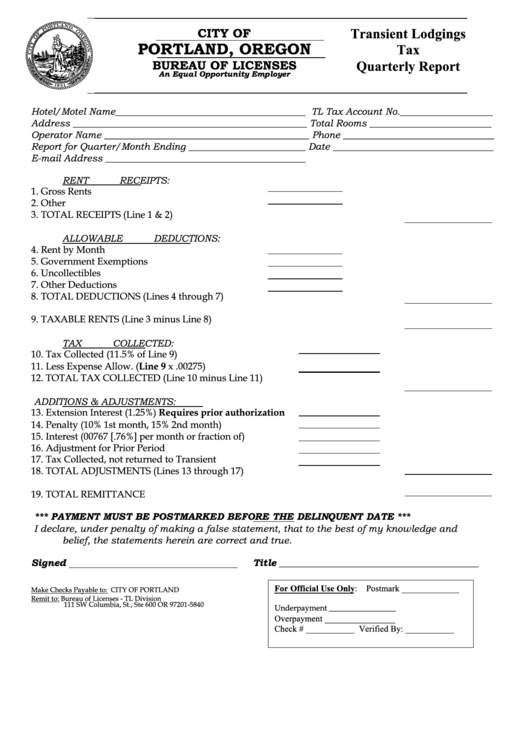

Transient Lodgings Tax Quarterly Report - City Of Portland Bureau Of Licenses

ADVERTISEMENT

CITY OF

Transient Lodgings

PORTLAND, OREGON

Tax

BUREAU OF LICENSES

Quarterly Report

An Equal Opportunity Employer

Hotel/Motel Name_______________________________________ TL Tax Account No.___________________

Address ________________________________________________ Total Rooms _________________________

Operator Name __________________________________________ Phone _______________________________

Report for Quarter/Month Ending ________________________ Date _________________________________

E-mail Address _________________________________________

RENT RECEIPTS:

1.

Gross Rents

2.

Other

3.

TOTAL RECEIPTS (Line 1 & 2)

ALLOWABLE DEDUCTIONS:

4.

Rent by Month

5.

Government Exemptions

6.

Uncollectibles

7.

Other Deductions

8.

TOTAL DEDUCTIONS (Lines 4 through 7)

9.

TAXABLE RENTS (Line 3 minus Line 8)

TAX COLLECTED:

10.

Tax Collected (11.5% of Line 9)

11.

Less Expense Allow. (Line 9 x .00275)

12.

TOTAL TAX COLLECTED (Line 10 minus Line 11)

ADDITIONS & ADJUSTMENTS:

13.

Extension Interest (1.25%) Requires prior authorization

14.

Penalty (10% 1st month, 15% 2nd month)

15.

Interest (00767 [.76%] per month or fraction of)

16.

Adjustment for Prior Period

17.

Tax Collected, not returned to Transient

18.

TOTAL ADJUSTMENTS (Lines 13 through 17)

19.

TOTAL REMITTANCE

*** PAYMENT MUST BE POSTMARKED BEFORE THE DELINQUENT DATE ***

I declare, under penalty of making a false statement, that to the best of my knowledge and

belief, the statements herein are correct and true.

Signed

Title _________________________________________

For Official Use Only:

Postmark _____________

Make Checks Payable to: CITY OF PORTLAND

Remit to: Bureau of Licenses - TL Division

111 SW Columbia, St., Ste 600 OR 97201-5840

Underpayment _________________

Overpayment ________________

Check # ___________

Verified By: ___________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1