Instructions For Sales Tax Returns - Town Of Winter Park

ADVERTISEMENT

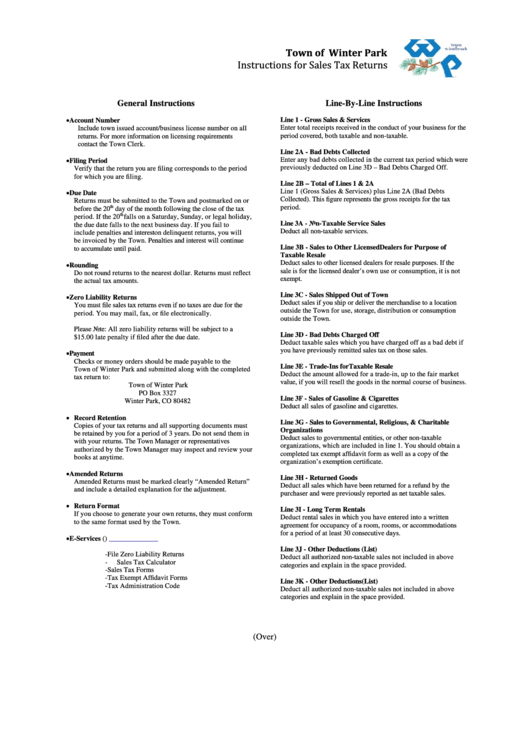

Instructions for Sales Tax Returns

Town of Winter Park

General Instructions

Line-By-Line Instructions

• Account Number

Line 1 - Gross Sales & Services

Enter total receipts received in the conduct of your business for the

Include town issued account/business license number on all

period covered, both taxable and non-taxable.

returns. For more information on licensing requirements

contact the Town Clerk.

Line 2A - Bad Debts Collected

• Filing Period

Enter any bad debts collected in the current tax period which were

previously deducted on Line 3D – Bad Debts Charged Off.

Verify that the return you are filing corresponds to the period

for which you are filing.

Line 2B – Total of Lines 1 & 2A

• Due Date

Line 1 (Gross Sales & Services) plus Line 2A (Bad Debts

Collected). This figure represents the gross receipts for the tax

Returns must be submitted to the Town and postmarked on or

period.

th

before the 20

day of the month following the close of the tax

th

period. If the 20

falls on a Saturday, Sunday, or legal holiday,

Line 3A - Non-Taxable Service Sales

the due date falls to the next business day. If you fail to

Deduct all non-taxable services.

include penalties and interest on delinquent returns, you will

be invoiced by the Town. Penalties and interest will continue

Line 3B - Sales to Other Licensed Dealers for Purpose of

to accumulate until paid.

Taxable Resale

• Rounding

Deduct sales to other licensed dealers for resale purposes. If the

sale is for the licensed dealer’s own use or consumption, it is not

Do not round returns to the nearest dollar. Returns must reflect

exempt.

the actual tax amounts.

• Zero Liability Returns

Line 3C - Sales Shipped Out of Town

Deduct sales if you ship or deliver the merchandise to a location

You must file sales tax returns even if no taxes are due for the

outside the Town for use, storage, distribution or consumption

period. You may mail, fax, or file electronically.

outside the Town.

Please Note: All zero liability returns will be subject to a

Line 3D - Bad Debts Charged Off

$15.00 late penalty if filed after the due date.

Deduct taxable sales which you have charged off as a bad debt if

you have previously remitted sales tax on those sales.

• Payment

Checks or money orders should be made payable to the

Line 3E - Trade-Ins for Taxable Resale

Town of Winter Park and submitted along with the completed

Deduct the amount allowed for a trade-in, up to the fair market

tax return to:

value, if you will resell the goods in the normal course of business.

Town of Winter Park

PO Box 3327

Line 3F - Sales of Gasoline & Cigarettes

Winter Park, CO 80482

Deduct all sales of gasoline and cigarettes.

• Record Retention

Line 3G - Sales to Governmental, Religious, & Charitable

Copies of your tax returns and all supporting documents must

Organizations

be retained by you for a period of 3 years. Do not send them in

Deduct sales to governmental entities, or other non-taxable

with your returns. The Town Manager or representatives

organizations, which are included in line 1. You should obtain a

authorized by the Town Manager may inspect and review your

completed tax exempt affidavit form as well as a copy of the

books at anytime.

organization’s exemption certificate.

• Amended Returns

Line 3H - Returned Goods

Amended Returns must be marked clearly “Amended Return”

Deduct all sales which have been returned for a refund by the

and include a detailed explanation for the adjustment.

purchaser and were previously reported as net taxable sales.

• Return Format

Line 3I - Long Term Rentals

If you choose to generate your own returns, they must conform

Deduct rental sales in which you have entered into a written

to the same format used by the Town.

agreement for occupancy of a room, rooms, or accommodations

for a period of at least 30 consecutive days.

• E-Services ( )

Line 3J - Other Deductions (List)

-

File Zero Liability Returns

Deduct all authorized non-taxable sales not included in above

-

Sales Tax Calculator

categories and explain in the space provided.

-

Sales Tax Forms

-

Tax Exempt Affidavit Forms

Line 3K - Other Deductions (List)

-

Tax Administration Code

Deduct all authorized non-taxable sales not included in above

categories and explain in the space provided.

(Over)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2