#1695#

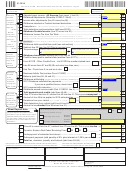

2011 Form 511NR - Nonresident/Part-Year Income Tax Return - Page 5

NOTE: Enclose this page ONLY if you have an amount shown on a schedule.

Name(s) shown

Your Social

on Form 511NR:

Security Number:

Worksheet for Amended Returns Only

(Form 511NR, Page 2, Line 43)

When amending Form 511NR you must adjust Form 511NR, line 43 (Oklahoma Income Tax Withheld) by

subtracting any previous overpayments or adding any tax previously paid. Use worksheet below.

BACK TO PAGE 2

1. Oklahoma income tax withheld

00

2. Amount paid with the original return plus additional paid after it was filed

00

(Do not include payments of underpayment of estimated tax interest)

3. Add lines 1 and 2

00

4. Overpayment, if any, shown on original return or as previously adjusted by Oklahoma

00

5. Subtract line 4 from line 3. Enter here and on line 43 of the amended Form 511NR

00

Donations from Refund

Schedule 511NR-F

This schedule allows you to make a donation from your refund to a variety of Oklahoma organizations. Information regarding each program,

their mission, how funds are utilized, and their mailing address are shown on page 6 of this form (Schedule 511NR-F Information). If you are

not receiving a refund, but would like to make a donation to one of these organizations, Schedule 511NR-F Information lists the mailing address

to mail your donation to the organization. If you are not receiving a refund and wish to donate to the Eastern Red Cedar Revolving Fund, please

see line 54 of Form 511NR.

Please check the box associated with the dollar amount you wish to have deducted from your refund and donated to that organization. Then

carry that figure over into the column at the right. When you carry your figure back to line 50 of Form 511NR, please list the line number of the

organization to which you donated. If you donate to more than one organization, please write a “99” in the box at line 50 of Form 511NR.

BACK TO PAGE 2

00

Oklahoma Wildlife Diversity Program ...............

$2

$5

$

...

?

1

1

00

Low Income Health Care Fund .........................

$2

$5

$

...

?

2

2

00

Oklahoma Breast and Cervical Cancer Fund ...

$2

$5

$

...

?

3

3

Support of Programs for Volunteers to Act

4

as Court Appointed Special Advocates

00

for Abused or Neglected Children.....................

$2

$5

$

...

?

4

00

Oklahoma Pet Overpopulation Fund ................

$2

$5

$

...

?

5

5

00

Support of the Oklahoma National Guard ........

$2

$5

$

...

?

6

6

00

Oklahoma Leukemia and Lymphoma Fund ......

$2

$5

$

...

?

7

7

Support of Programs for Regional Food Banks

00

in Oklahoma .....................................................

$2

$5

$

...

?

8

8

00

Support of Folds of Honor Scholarship Program

$2

$5

$

...

9

?

9

Y.M.C.A. Youth and Government Program

10

00

(Donation may not exceed $25.) ......................

$2

$5

$

.

?

10

Multiple Sclerosis Society Fund

11

00

(Donation may not exceed $25.) ......................

$2

$5

$

.

?

11

00

Support Oklahoma Honor Flights .....................

$2

$5

$

.

12

?

12

00

Eastern Red Cedar Revolving Fund .................

$2

$5

$

.

?

13

13

00

Total donations (add lines 1-13, enter total here and on line 50 of Form 511NR) .....

14

14

1

1 2

2 3

3 4

4 5

5