Clear Form

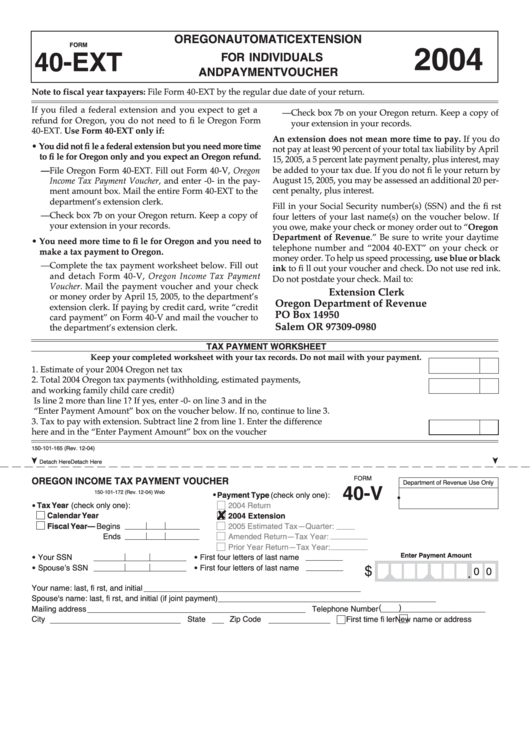

OREGON AUTOMATIC EXTENSION

FORM

2004

40-EXT

FOR INDIVIDUALS

AND PAYMENT VOUCHER

Note to fiscal year taxpayers: File Form 40-EXT by the regular due date of your return.

If you filed a federal extension and you expect to get a

—Check box 7b on your Oregon return. Keep a copy of

refund for Oregon, you do not need to fi le Oregon Form

your extension in your records.

40-EXT. Use Form 40-EXT only if:

An extension does not mean more time to pay. If you do

• You did not fi le a federal extension but you need more time

not pay at least 90 percent of your total tax liability by April

to fi le for Oregon only and you expect an Oregon refund.

15, 2005, a 5 percent late payment penalty, plus interest, may

be added to your tax due. If you do not fi le your return by

—File Oregon Form 40-EXT. Fill out Form 40-V, Oregon

August 15, 2005, you may be assessed an additional 20 per-

Income Tax Payment Voucher, and enter -0- in the pay-

cent penalty, plus interest.

ment amount box. Mail the entire Form 40-EXT to the

department’s extension clerk.

Fill in your Social Security number(s) (SSN) and the fi rst

—Check box 7b on your Oregon return. Keep a copy of

four letters of your last name(s) on the voucher below. If

your extension in your records.

you owe, make your check or money order out to “Oregon

Department of Revenue.” Be sure to write your daytime

• You need more time to fi le for Oregon and you need to

telephone number and “2004 40-EXT” on your check or

make a tax payment to Oregon.

money order. To help us speed processing, use blue or black

—Complete the tax payment worksheet below. Fill out

ink to fi ll out your voucher and check. Do not use red ink.

and detach Form 40-V, Oregon Income Tax Payment

Do not postdate your check. Mail to:

Voucher. Mail the payment voucher and your check

Extension Clerk

or money order by April 15, 2005, to the department’s

Oregon Department of Revenue

extension clerk. If paying by credit card, write “credit

PO Box 14950

card payment” on Form 40-V and mail the voucher to

Salem OR 97309-0980

the department’s extension clerk.

TAX PAYMENT WORKSHEET

Keep your completed worksheet with your tax records. Do not mail with your payment.

1. Estimate of your 2004 Oregon net tax liability ............................................................................................... 1

2. Total 2004 Oregon tax payments (withholding, estimated payments,

and working family child care credit).............................................................................................................. 2

Is line 2 more than line 1? If yes, enter -0- on line 3 and in the

“Enter Payment Amount” box on the voucher below. If no, continue to line 3.

3. Tax to pay with extension. Subtract line 2 from line 1. Enter the difference

here and in the “Enter Payment Amount” box on the voucher below ....................................................... 3

150-101-165 (Rev. 12-04)

Detach Here

Detach Here

FORM

OREGON INCOME TAX PAYMENT VOUCHER

Department of Revenue Use Only

40-V

150-101-172 (Rev. 12-04) Web

•

Payment Type (check only one):

•

•

Tax Year (check only one):

2004 Return

✘

Calendar Year

2004 Extension

Fiscal Year— Begins

2005 Estimated Tax—Quarter:

Clear Form

Ends

Amended Return—Tax Year:

Prior Year Return—Tax Year:

•

•

Enter Payment Amount

Your SSN

First four letters of last name

•

•

Spouse’s SSN

First four letters of last name

$

0 0

.

Your name: last, fi rst, and initial

Spouse's name: last, fi rst, and initial (if joint payment)

(

)

Mailing address

Telephone Number

City

State

Zip Code

First time fi ler

New name or address

1

1