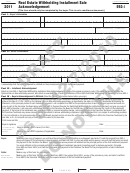

California Form 593-I Draft - Real Estate Withholding Installment Sale Acknowledgement - 2011 Page 4

ADVERTISEMENT

Real Estate Escrow Person

Additional Information

Instructions

To get withholding forms or publications,

or to speak to a representative, contact our

Make a copy of this form for your records. Send

Withholding Services and Compliance’s

the completed original Form 593-

I

, a copy of the

automated telephone service at:

promissory note, the seller’s certified Form 593,

888.792.4900, or

and Form 593-V, with the required withholding

916.845.4900

amount on the first installment payment to

FAX 916.845.9512

the FTB. Get Form 593 instructions for more

information.

Or write to:

WITHHOLDING SERVICES

Interest and Penalties

AND COMPLIANCE

Interest will be assessed on late withholding

FRANCHISE TAX BOARD

payments and is computed from the due

PO BOX 942867

date to the date paid. If the real estate

SACRAMENTO CA 94267-0651

escrow person does not notify the buyer of

You can download, view, and print California

the withholding requirements in writing, the

tax forms and publications at ftb.ca.gov.

penalty is the greater of $500 or 10% of the

required withholding.

Or to get forms by mail write to:

If the buyer (after notification) or other

TAX FORMS REQUEST UNIT

withholding agent does not withhold, the

FRANCHISE TAX BOARD

penalty is the greater of $500 or 10% of the

PO BOX 307

required withholding.

RANCHO CORDOVA CA 95741-0307

If the buyer or other withholding agent does

Internet and Telephone Assistance

not furnish complete and correct copies of

Website:

ftb.ca.gov

Form 593 to the seller by the due date, the

Telephone: 800.852.5711 from within the

penalty is $50 per Form 593. If the failure

United States

is due to an intentional disregard of the

916.845.6500 from outside the

requirement, the penalty is the greater of $100

United States

or 10% of the required withholding.

TTY/TDD:

800.822.6268 for persons with

If the buyer or other withholding agent does

hearing or speech impairments

not furnish complete and correct copies of

Asistencia Por Internet y Teléfono

Form 593 to the FTB by the due date but does

Sitio web:

ftb.ca.gov

file them within 30 days of the due date, the

Teléfono:

800.852.5711 dentro de los

penalty is $15 per Form 593. If Form 593 is

Estados Unidos

filed more than 30 days but less than 180

916.845.6500 fuera de los

days after the due date, the penalty is $30 per

Estados Unidos

Form 593. If Form 593 is filed more than 180

TTY/TDD:

800.822.6268 personas con

days after the due date, the penalty is $50 per

discapacidades auditivas y del

Form 593. If the failure is due to an intentional

habla

disregard of the requirement, the penalty is

the greater of $100 or 10% of the required

withholding.

Page Form 593-

I

Instructions 2010

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4