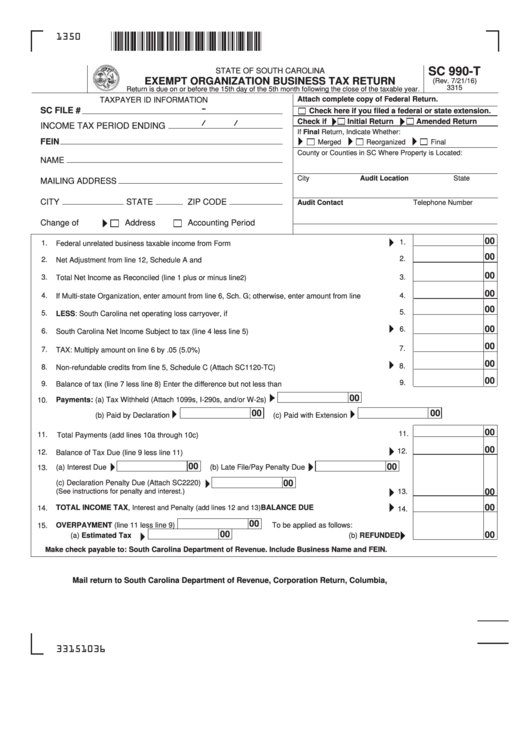

Form Sc 990-T - Exempt Organization Business Tax Return - 2016

ADVERTISEMENT

1350

SC 990-T

STATE OF SOUTH CAROLINA

EXEMPT ORGANIZATION BUSINESS TAX RETURN

(Rev. 7/21/16)

3315

Return is due on or before the 15th day of the 5th month following the close of the taxable year.

Attach complete copy of Federal Return.

TAXPAYER ID INFORMATION

SC FILE #

Check here if you filed a federal or state extension.

/

/

Check if

Initial Return

Amended Return

INCOME TAX PERIOD ENDING

If Final Return, Indicate Whether:

FEIN

Merged

Reorganized

Final

County or Counties in SC Where Property is Located:

NAME

City

Audit Location

State

MAILING ADDRESS

CITY

STATE

ZIP CODE

Audit Contact

Telephone Number

Change of

Address

Accounting Period

00

1.

1.

Federal unrelated business taxable income from Form 990T.................................................................

00

2.

2.

Net Adjustment from line 12, Schedule A and B.....................................................................................

00

3.

3.

Total Net Income as Reconciled (line 1 plus or minus line

2)......................................................................

00

4.

If Multi-state Organization, enter amount from line 6, Sch. G; otherwise, enter amount from line 3.......

4.

00

5.

5.

LESS: South Carolina net operating loss carryover, if applicable...........................................................

00

6.

6.

South Carolina Net Income Subject to tax (line 4 less line 5).................................................................

00

7.

7.

TAX: Multiply amount on line 6 by .05 (5.0%).........................................................................................

00

8.

8.

Non-refundable credits from line 5, Schedule C (Attach SC1120-TC)....................................................

00

9.

9.

Balance of tax (line 7 less line 8) Enter the difference but not less than zero.........................................

00

Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s)

10.

00

00

(b) Paid by Declaration

(c) Paid with Extension

00

11.

11.

Total Payments (add lines 10a through 10c)..........................................................................................

00

12.

12.

Balance of Tax Due (line 9 less line 11)..................................................................................................

00

00

(a) Interest Due

(b) Late File/Pay Penalty Due

13.

(c) Declaration Penalty Due (Attach SC2220)

00

00

(See instructions for penalty and interest.)

13.

00

TOTAL INCOME TAX,

................................. BALANCE DUE

14.

Interest and Penalty (add lines 12 and 13)

14.

00

OVERPAYMENT (line 11 less line 9)

To be applied as follows:

15.

00

00

(a) Estimated Tax

(b) REFUNDED

M

ake check payable to: South Carolina Department of Revenue. Include Business Name and FEIN.

Mail return to South Carolina Department of Revenue, Corporation Return, Columbia, S.C. 29214-0100.

33151036

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3