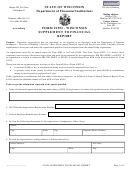

Form Char-497 - Annual Financial Report Page 4

ADVERTISEMENT

WHERE TOTAL SUPPORT AND REVENUE IS:

$75,000 or less . . . . . . . .

NO Public Accountant’s Report is needed: Skip to CERTIFICATION BY CHARITABLE ORGANIZATION, below

$75,001 to $150,000 . . . . .

Have an Independent Public Accountant complete and sign the "(REVIEW)" section below OR, SEE

INSTRUCTIONS: INDEPENDENT PUBLIC ACCOUNTANT’S REPORT. Then complete CERTIFICATION BY CHARITABLE

ORGANIZATION, below.

More than $150,000 . . . . . .

EITHER have an Independent Public Accountant Complete and sign the "(AUDIT)" section below OR, See

INSTRUCTIONS: INDEPENDENT PUBLIC ACCOUNTANT’S REPORT. Then complete CERTIFICATION BY

CHARITABLE ORGANIZATION, below.

INDEPENDENT PUBLIC ACCOUNTANT’S REPORT (REVIEW)

We have reviewed the accompanying balance sheet (Part IV) of Form 990 of

as of

, and the related statement of support, revenue and expenses and changes in fund balances (Part I) and statement of functional

expenses (Part II) of Form 990 for the year then ended, in accordance with standards established by the American Institute of Certified Public Accountants. All information included

in these financial statements is the representation of the management of the charitable organization.

A review consists principally of inquiries of company personnel and analytical procedures applied to financial data. It is substantially less in scope than an audit in accordance

with generally accepted auditing standards, the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express

such an opinion. Based on this review, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in

conformity with generally accepted accounting principles.

NAME OF FIRM OR INDIVIDUAL PRACTITIONER

ADDRESS

DATE

SIGNATURE OF FIRM OR INDIVIDUAL PRACTITIONER

IF FIRM, NAME OF ENGAGEMENT PARTNER

INDEPENDENT PUBLIC ACCOUNTANT’S REPORT (AUDIT)

We have audited the balance sheet (Part IV) of Form 990 of

as of

, and the related statement of support, revenue and expenses and changes in fund balances (Part I) and statement of

functional expenses (Part II) for the year then ended included in the accompanying Internal Revenue Service Form 990. These financial statements are the responsibility of the

Organization’s management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with generally accepted auditing standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of the organization as of the above date, and the results of

its operations for the year then ended, in conformity with generally accepted accounting principles.

Our audit was made for the purpose of forming an opinion on the financial statements referred to in the first paragraph taken as a whole. The accompanying information on pages

to

is presented for purposes of additional analysis and is not a required part of the financial statements referred to above. Such

information, except for that portion marked "unaudited," on which we express no opinion, has been subjected to the auditing procedures applied in the audit of the financial statements

referred to above; and, in our opinion, the information is fairly stated in all material respects in relation to these financial statements taken as a whole.

NAME OF FIRM OR INDIVIDUAL PRACTITIONER

ADDRESS

DATE

SIGNATURE OF FIRM OR INDIVIDUAL PRACTITIONER

IF FIRM, NAME OF ENGAGEMENT PARTNER

CERTIFICATION BY CHARITABLE ORGANIZATION

Under penalties of perjury, we declare that we reviewed this report, accompanying Federal Form 990 with attached schedules and, to the best of

our knowledge and belief, it is true, correct and complete in accordance with the rules of the New York State Office of the Attorney General,

Charities Bureau and the instructions applicable to this report.

Signature of President or Authorized Officer

Title

Date Signed

Signature of Chief Financial Officer

Title

Date Signed

After this report has been fully executed by two distinct officials, send it with appropriate ATTACHMENTS and FEE to:

Office of the Attorney General, Charities Bureau, 120 Broadway, New York, New York 10271

If contributions received exceed $25,000, submit the appropriate fee, indicated below:

$10, if total support and revenue is $150,000 or less;

$25, if total support and revenue exceeds $150,000.

CHAR497 2\99

PAGE 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4