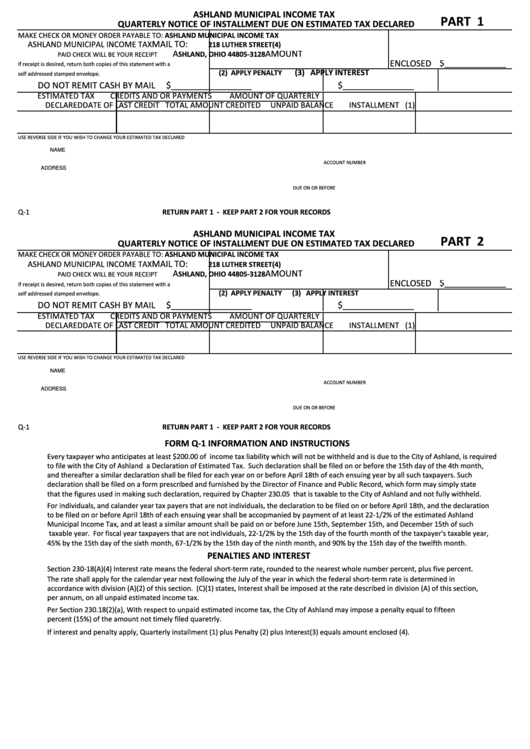

ASHLAND MUNICIPAL INCOME TAX

PART 1

QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

MAKE CHECK OR MONEY ORDER PAYABLE TO:

ASHLAND MUNICIPAL INCOME TAX

MAIL TO:

ASHLAND MUNICIPAL INCOME TAX

218 LUTHER STREET

(4)

A

AMOUNT

SHLAND, OHIO 44805-3128

PAID CHECK WILL BE YOUR RECEIPT

ENCLOSED

$_____________

If receipt is desired, return both copies of this statement with a

(3) APPLY INTEREST

(2) APPLY PENALTY

self addressed stamped envelope.

DO NOT REMIT CASH BY MAIL

$_________________

$_______________

ESTIMATED TAX

CREDITS AND OR PAYMENTS

AMOUNT OF

QUARTERLY

DECLARED

DATE OF LAST CREDIT

TOTAL AMOUNT CREDITED

UNPAID BALANCE

INSTALLMENT (1)

USE REVERSE SIDE IF YOU WISH TO CHANGE YOUR ESTIMATED TAX DECLARED

NAME

ACCOUNT NUMBER

ADDRESS

DUE ON OR BEFORE

Q-1

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

ASHLAND MUNICIPAL INCOME TAX

PART 2

QUARTERLY NOTICE OF INSTALLMENT DUE ON ESTIMATED TAX DECLARED

MAKE CHECK OR MONEY ORDER PAYABLE TO:

ASHLAND MUNICIPAL INCOME TAX

MAIL TO:

ASHLAND MUNICIPAL INCOME TAX

218 LUTHER STREET

(4)

A

AMOUNT

SHLAND, OHIO 44805-3128

PAID CHECK WILL BE YOUR RECEIPT

ENCLOSED

$_____________

If receipt is desired, return both copies of this statement with a

(2) APPLY PENALTY

(3) APPLY INTEREST

self addressed stamped envelope.

DO NOT REMIT CASH BY MAIL

$_________________

$_______________

ESTIMATED TAX

CREDITS AND OR PAYMENTS

AMOUNT OF

QUARTERLY

DECLARED

DATE OF LAST CREDIT

TOTAL AMOUNT CREDITED

UNPAID BALANCE

INSTALLMENT (1)

USE REVERSE SIDE IF YOU WISH TO CHANGE YOUR ESTIMATED TAX DECLARED

NAME

ACCOUNT NUMBER

ADDRESS

DUE ON OR BEFORE

Q-1

RETURN PART 1 - KEEP PART 2 FOR YOUR RECORDS

FORM Q-1 INFORMATION AND INSTRUCTIONS

Every taxpayer who anticipates at least $200.00 of income tax liability which will not be withheld and is due to the City of Ashland, is required

to file with the City of Ashland a Declaration of Estimated Tax. Such declaration shall be filed on or before the 15th day of the 4th month,

and thereafter a similar declaration shall be filed for each year on or before April 18th of each ensuing year by all such taxpayers. Such

declaration shall be filed on a form prescribed and furnished by the Director of Finance and Public Record, which form may simply state

that the figures used in making such declaration, required by Chapter 230.05 that is taxable to the City of Ashland and not fully withheld.

For individuals, and calander year tax payers that are not individuals, the declaration to be filed on or before April 18th, and the declaration

to be filed on or before April 18th of each ensuing year shall be accopmanied by payment of at least 22-1/2% of the estimated Ashland

Municipal Income Tax, and at least a similar amount shall be paid on or before June 15th, September 15th, and December 15th of such

taxable year. For fiscal year taxpayers that are not individuals, 22-1/2% by the 15th day of the fourth month of the taxpayer's taxable year,

45% by the 15th day of the sixth month, 67-1/2% by the 15th day of the ninth month, and 90% by the 15th day of the twelfth month.

PENALTIES AND INTEREST

Section 230-18(A)(4) Interest rate means the federal short-term rate, rounded to the nearest whole number percent, plus five percent.

The rate shall apply for the calendar year next following the July of the year in which the federal short-term rate is determined in

accordance with division (A)(2) of this section. (C)(1) states, Interest shall be imposed at the rate described in division (A) of this section,

per annum, on all unpaid estimated income tax.

Per Section 230.18(2)(a), With respect to unpaid estimated income tax, the City of Ashland may impose a penalty equal to fifteen

percent (15%) of the amount not timely filed quaretrly.

If interest and penalty apply, Quarterly installment (1) plus Penalty (2) plus Interest(3) equals amount enclosed (4).

1

1