Marriott Employees' Federal Credit Union Wire Transfer Request Form

ADVERTISEMENT

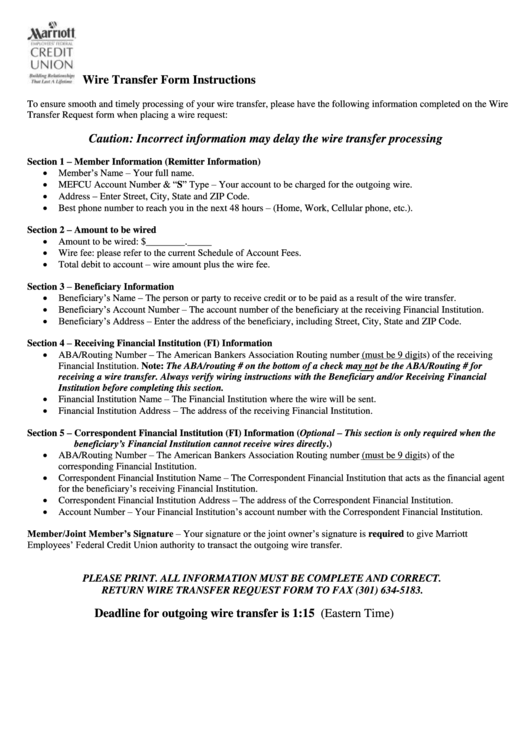

Wire Transfer Form Instructions

To ensure smooth and timely processing of your wire transfer, please have the following information completed on the Wire

Transfer Request form when placing a wire request:

Caution: Incorrect information may delay the wire transfer processing

Section 1 – Member Information (Remitter Information)

Member’s Name – Your full name.

MEFCU Account Number & “S” Type – Your account to be charged for the outgoing wire.

Address – Enter Street, City, State and ZIP Code.

Best phone number to reach you in the next 48 hours – (Home, Work, Cellular phone, etc.).

Section 2 – Amount to be wired

Amount to be wired: $________._____

Wire fee: please refer to the current Schedule of Account Fees.

Total debit to account – wire amount plus the wire fee.

Section 3 – Beneficiary Information

Beneficiary’s Name – The person or party to receive credit or to be paid as a result of the wire transfer.

Beneficiary’s Account Number – The account number of the beneficiary at the receiving Financial Institution.

Beneficiary’s Address – Enter the address of the beneficiary, including Street, City, State and ZIP Code.

Section 4 – Receiving Financial Institution (FI) Information

ABA/Routing Number – The American Bankers Association Routing number (must be 9 digits) of the receiving

Financial Institution. Note: The ABA/routing # on the bottom of a check may not be the ABA/Routing # for

receiving a wire transfer. Always verify wiring instructions with the Beneficiary and/or Receiving Financial

Institution before completing this section.

Financial Institution Name – The Financial Institution where the wire will be sent.

Financial Institution Address – The address of the receiving Financial Institution.

Section 5 – Correspondent Financial Institution (FI) Information (Optional – This section is only required when the

beneficiary’s Financial Institution cannot receive wires directly.)

ABA/Routing Number – The American Bankers Association Routing number (must be 9 digits) of the

corresponding Financial Institution.

Correspondent Financial Institution Name – The Correspondent Financial Institution that acts as the financial agent

for the beneficiary’s receiving Financial Institution.

Correspondent Financial Institution Address – The address of the Correspondent Financial Institution.

Account Number – Your Financial Institution’s account number with the Correspondent Financial Institution.

Member/Joint Member’s Signature – Your signature or the joint owner’s signature is required to give Marriott

Employees’ Federal Credit Union authority to transact the outgoing wire transfer.

PLEASE PRINT. ALL INFORMATION MUST BE COMPLETE AND CORRECT.

RETURN WIRE TRANSFER REQUEST FORM TO FAX (301) 634-5183.

Deadline for outgoing wire transfer is 1:15 p.m. ET (Eastern Time)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2