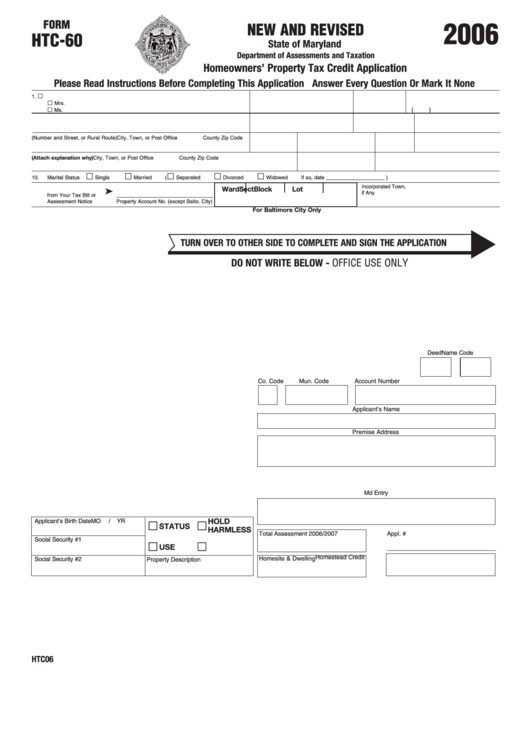

Form Htc-60 - Homeowners' Property Tax Credit Application - 2006

ADVERTISEMENT

a

a

a

a

a

a

a

a

FORM

2006

NEW AND REVISED

HTC-60

State of Maryland

Department of Assessments and Taxation

Homeowners’ Property Tax Credit Application

Please Read Instructions Before Completing This Application Answer Every Question Or Mark It None

1.

Mr.

Last Name

First Name and Middle Initial

2.

Your Social Security Number

3. Your Birth Date

4. Daytime Telephone No.

Mrs.

(

)

Ms.

5.

Full Name of Spouse or Co-Owner living in the property

6.

His/Her Social Security Number

7. His/Her Birth Date

a

a

8.

Property Address (Number and Street, or Rural Route)

City, Town, or Post Office

County

Zip Code

a

a

9.

Mailing Address if Different from Above (Attach explanation why)

City, Town, or Post Office

County

Zip Code

10.

Marital Status

Single

Married

(

Separated

Divorced

Widowed

If so, date ____________________ )

Incorporated Town,

11.

Furnish the Following

Ward

Sect

Block

Lot

®

if Any

from Your Tax Bill or

_________________________________

Assessment Notice

Property Account No. (except Balto. City)

For Baltimore City Only

TURN OVER TO OTHER SIDE TO COMPLETE AND SIGN THE APPLICATION

DO NOT WRITE BELOW - OFFICE USE ONLY

Deed

Name Code

Co. Code

Mun. Code

Account Number

Applicant’s Name

Premise Address

Md Entry

HOLD

Applicant’s Birth Date

MO

/

YR

STATUS

HARMLESS

Total Assessment 2006/2007

Appl. #

Social Security #1

USE

________________________________

Homestead Credit

Homesite & Dwelling

Social Security #2

Property Description

HTC06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2