Schedules X And Y For The Individual Filer - City Of Cincinnati, Ohio - 2003

ADVERTISEMENT

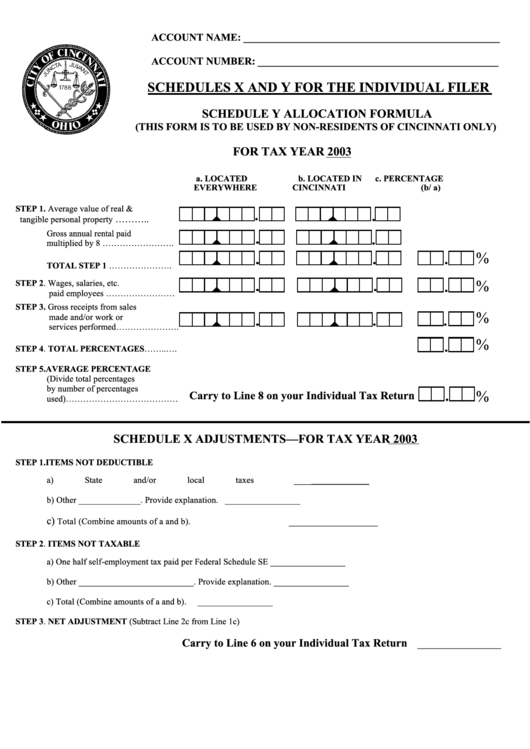

ACCOUNT NAME: _________________________________________________

ACCOUNT NUMBER: ______________________________________________

SCHEDULES X AND Y FOR THE INDIVIDUAL FILER

SCHEDULE Y ALLOCATION FORMULA

(THIS FORM IS TO BE USED BY NON-RESIDENTS OF CINCINNATI ONLY)

FOR TAX YEAR 2003

a. LOCATED

b. LOCATED IN

c. PERCENTAGE

EVERYWHERE

CINCINNATI

(b/ a)

STEP 1. Average value of real &

………..

tangible personal property

Gross annual rental paid

multiplied by 8 …………………….

%

TOTAL STEP 1 ………………….

%

STEP 2. Wages, salaries, etc.

paid employees ……………………

STEP 3. Gross receipts from sales

%

made and/or work or

services performed………………….

%

STEP 4. TOTAL PERCENTAGES……..….

STEP 5. AVERAGE PERCENTAGE

(Divide total percentages

by number of percentages

%

Carry to Line 8 on your Individual Tax Return

used)…………………………………

SCHEDULE X ADJUSTMENTS—FOR TAX YEAR 2003

STEP 1. ITEMS NOT DEDUCTIBLE

a) State and/or local taxes

_________________

b) Other ______________. Provide explanation.

_________________

c)

_________________

Total (Combine amounts of a and b).

STEP 2. ITEMS NOT TAXABLE

a) One half self-employment tax paid per Federal Schedule SE

_________________

b) Other __________________________. Provide explanation.

_________________

c) Total (Combine amounts of a and b).

_________________

STEP 3. NET ADJUSTMENT (Subtract Line 2c from Line 1c)

Carry to Line 6 on your Individual Tax Return

________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1