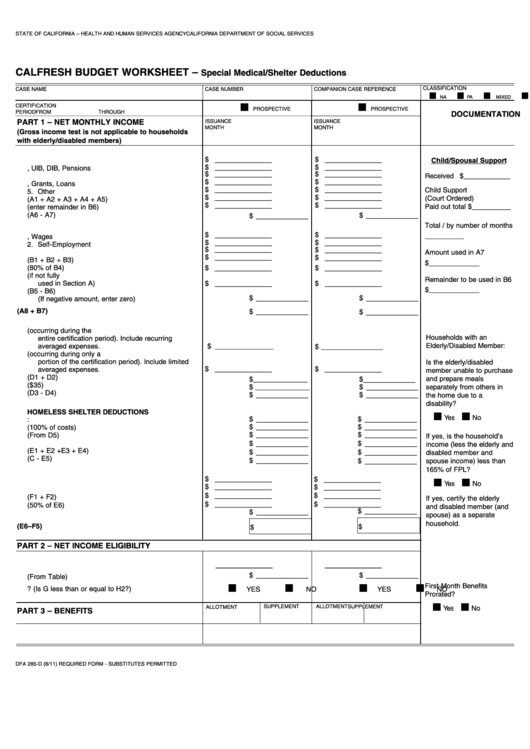

STATE OF CALIFORNIA – HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CALFRESH BUDGET WORKSHEET –

Special Medical/Shelter Deductions

CLASSIFICATION

CASE NAME

CASE NUMBER

COMPANION CASE REFERENCE

■ ■

■ ■

■ ■

■ ■

NA

PA

MIXED

TC

■ ■

■ ■

CERTIFICATION

PROSPECTIVE

PROSPECTIVE

PERIOD

FROM

THROUGH

DOCUMENTATION

PART 1 – NET MONTHLY INCOME

ISSUANCE

ISSUANCE

MONTH

MONTH

(Gross income test is not applicable to households

with elderly/disabled members)

A. NONEXEMPT GROSS UNEARNED INCOME

____________

____________

$

$

1. Cash Aid

Child/Spousal Support

____________

____________

$

$

2. Social Security, UIB, DIB, Pensions

____________

____________

$

$

3. Child/Spousal Support

Received $____________

____________

____________

$

$

4. Scholarships, Grants, Loans

____________

____________

$

$

Child Support

5. Other

____________

____________

$

$

(Court Ordered)

6. Gross Unearned Income (A1 + A2 + A3 + A4 + A5)

____________

____________

$

$

Paid out total $__________

7. Less Child Support Paid (enter remainder in B6)

___________

___________

8. Total Gross Unearned Income (A6 - A7)

$

$

Total / by number of months

B. NONEXEMPT GROSS EARNED INCOME

____________

____________

$

$

__________

1. Gross Salary, Wages

____________

____________

$

$

2. Self-Employment

____________

____________

$

$

3. Training Allowance

Amount used in A7

____________

____________

$

$

4. Gross Earned Income (B1 + B2 + B3)

$_____________

____________

____________

5. Adjusted Gross Earned Income (80% of B4)

$

$

6. Less Remainder of Child Support Paid (if not fully

Remainder to be used in B6

____________

____________

used in Section A)

$

$

$_____________

7. Total Gross Earned Income (B5 - B6)

___________

___________

$

$

(If negative amount, enter zero)

C. TOTAL NONEXEMPT GROSS INCOME (A8 + B7)

___________

___________

$

$

D. EXCESS MEDICAL EXPENSES

1. Expected Recurring Expenses (occurring during the

Households with an

entire certification period). Include recurring

Elderly/Disabled Member:

averaged expenses.

$ _______________

$ ________________

2. Limited Period Expenses (occurring during only a

portion of the certification period). Include limited

Is the elderly/disabled

____________

____________

$

$

averaged expenses.

member unable to purchase

3. Total Allowable Expenses (D1 + D2)

___________

and prepare meals

$______________

$

4. Less Medical Expense Allowance ($35)

___________

$ ______________

$

separately from others in

5. Excess Medical Expenses (D3 - D4)

___________

___________

$

$

the home due to a

disability?

E. STANDARD/DEPENDENT CARE/MEDICAL/

HOMELESS SHELTER DEDUCTIONS

■ ■

■ ■

___________

Yes

No

___________

$

$

1. Standard Deduction:

___________

___________

$

$

2. Dependent Care (100% of costs)

___________

___________

$

$

3. Excess Medical Expenses (From D5)

If yes, is the household’s

___________

___________

4. Homeless Shelter Deduction

$

$

income (less the elderly and

5. Total Deductions (E1 + E2 +E3 + E4)

___________

___________

$

$

disabled member and

6. Total Adjusted Income (C - E5)

___________

___________

$

$

spouse income) less than

165% of FPL?

F. SHELTER DEDUCTION

____________

____________

■ ■

■ ■

$

$

1. Total Housing Costs

Yes

No

____________

____________

$

$

2. Total Utility Allowance

____________

____________

$

$

3. Total Shelter costs (F1 + F2)

If yes, certify the elderly

____________

____________

$

$

4. Allowable Shelter Costs (50% of E6)

and disabled member (and

___________

___________

$

$

5. Excess Shelter Costs F3-F4

spouse) as a separate

household.

G. NET MONTHLY INCOME (E6–F5)

$

$

PART 2 – NET INCOME ELIGIBILITY

H. NET INCOME TEST

____________

____________

1. Household Size

___________

___________

$

$

2. Maximum Net Income Allowable (From Table)

■ ■

■ ■

■ ■

■ ■

First-Month Benefits

3. Net Income Eligible? (Is G less than or equal to H2?)

YES

NO

YES

NO

Prorated?

■ ■

■ ■

SUPPLEMENT

ALLOTMENT

ALLOTMENT

SUPPLEMENT

Yes

No

PART 3 – BENEFITS

E.W. Initials/Date

DFA 285-D (8/11) REQUIRED FORM - SUBSTITUTES PERMITTED

1

1 2

2