Centrally Assessed Report For Private Car Line Companies Data For Year Ending December 31, 2007

ADVERTISEMENT

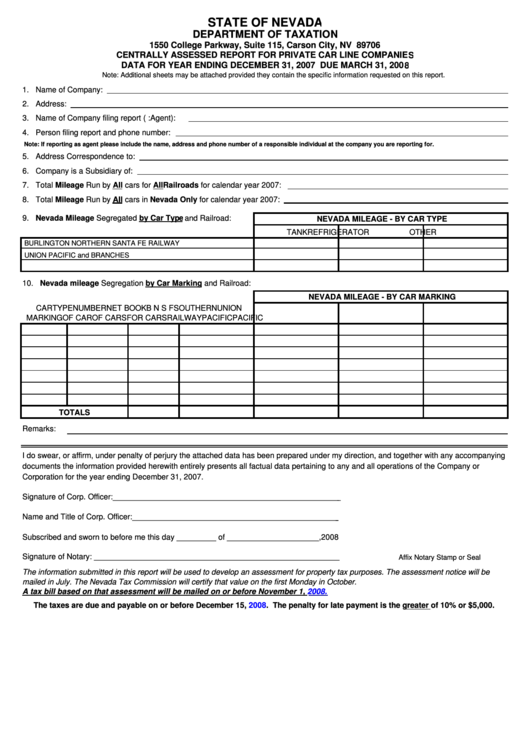

STATE OF NEVADA

DEPARTMENT OF TAXATION

1550 College Parkway, Suite 115, Carson City, NV 89706

CENTRALLY ASSESSED REPORT FOR PRIVATE CAR LINE COMPANIES

DATA FOR YEAR ENDING DECEMBER 31, 2007 DUE MARCH 31, 2008

Note: Additional sheets may be attached provided they contain the specific information requested on this report.

1. Name of Company:

2. Address:

_

3. Name of Company filing report (i.e.:Agent):

4. Person filing report and phone number:

Note: If reporting as agent please include the name, address and phone number of a responsible individual at the company you are reporting for.

5. Address Correspondence to:

6. Company is a Subsidiary of:

7. Total Mileage Run by All cars for All Railroads for calendar year 2007:

8. Total Mileage Run by All cars in Nevada Only for calendar year 2007:

9. Nevada Mileage Segregated by Car Type and Railroad:

NEVADA MILEAGE - BY CAR TYPE

TANK

REFRIGERATOR

OTHER

BURLINGTON NORTHERN SANTA FE RAILWAY

UNION PACIFIC and BRANCHES

U.P.PORTION FORMERLY SOUTHERN PACIFIC and BRANCHES

10. Nevada mileage Segregation by Car Marking and Railroad:

NEVADA MILEAGE - BY CAR MARKING

CAR

TYPE

NUMBER

NET BOOK

B N S F

SOUTHERN

UNION

MARKING

OF CAR

OF CARS

FOR CARS

RAILWAY

PACIFIC

PACIFIC

TOTALS

Remarks:

I do swear, or affirm, under penalty of perjury the attached data has been prepared under my direction, and together with any accompanying

documents the information provided herewith entirely presents all factual data pertaining to any and all operations of the Company or

Corporation for the year ending December 31, 2007.

Signature of Corp. Officer:_____________________________________________________

Name and Title of Corp. Officer:________________________________________________

Subscribed and sworn to before me this day _________ of _____________________,2008

Signature of Notary: ________________________________________________________

Affix Notary Stamp or Seal

The information submitted in this report will be used to develop an assessment for property tax purposes. The assessment notice will be

mailed in July. The Nevada Tax Commission will certify that value on the first Monday in October.

A tax bill based on that assessment will be mailed on or before November 1,

2008.

The taxes are due and payable on or before December 15, 2008. The penalty for late payment is the greater of 10% or $5,000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1