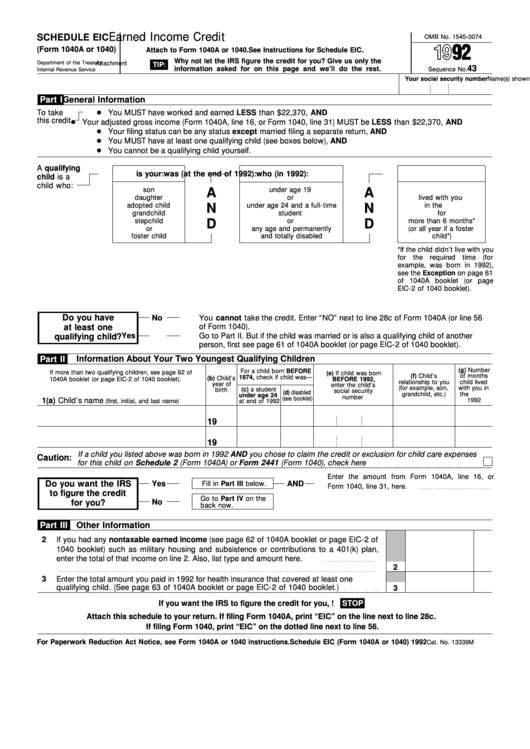

Schedule Eic (Form 1040a Or 1040) - Earned Income Credit - 1992

ADVERTISEMENT

Earned Income Credit

SCHEDULE EIC

OMB No. 1545-0074

(Form 1040A or 1040)

Attach to Form 1040A or 1040.

See Instructions for Schedule EIC.

Why not let the IRS figure the credit for you? Give us only the

Department of the Treasury

Attachment

TIP:

43

information asked for on this page and we’ll do the rest.

Sequence No.

Internal Revenue Service

Name(s) shown on return

Your social security number

Part I

General Information

To take

You MUST have worked and earned LESS than $22,370, AND

this credit

Your adjusted gross income (Form 1040A, line 16, or Form 1040, line 31) MUST be LESS than $22,370, AND

Your filing status can be any status except married filing a separate return, AND

You MUST have at least one qualifying child (see boxes below), AND

You cannot be a qualifying child yourself.

A qualifying

is your:

was (at the end of 1992):

who (in 1992):

child is a

child who:

son

A

under age 19

A

daughter

or

lived with you

adopted child

N

under age 24 and a full-time

N

in the U.S.

grandchild

student

for

stepchild

D

or

D

more than 6 months*

or

any age and permanently

(or all year if a foster

foster child

and totally disabled

child*)

*If the child didn’t live with you

for the required time (for

example, was born in 1992),

see the Exception on page 61

of 1040A booklet (or page

EIC-2 of 1040 booklet).

Do you have

No

You cannot take the credit. Enter “NO” next to line 28c of Form 1040A (or line 56

of Form 1040).

at least one

Yes

Go to Part II. But if the child was married or is also a qualifying child of another

qualifying child?

person, first see page 61 of 1040A booklet (or page EIC-2 of 1040 booklet).

Information About Your Two Youngest Qualifying Children

Part II

(g) Number

For a child born BEFORE

If more than two qualifying children, see page 62 of

(e) If child was born

(f) Child’s

of months

1974, check if child was—

(b) Child’s

BEFORE 1992,

1040A booklet (or page EIC-2 of 1040 booklet).

relationship to you

child lived

year of

enter the child’s

(for example, son,

with you in

(c) a student

birth

social security

(d) disabled

grandchild, etc.)

the U.S. in

under age 24

number

(see booklet)

1(a) Child’s name

1992

(first, initial, and last name)

at end of 1992

19

19

If a child you listed above was born in 1992 AND you chose to claim the credit or exclusion for child care expenses

Caution:

for this child on Schedule 2 (Form 1040A) or Form 2441 (Form 1040), check here

Enter the amount from Form 1040A, line 16, or

Do you want the IRS

Yes

Fill in Part III below.

AND

Form 1040, line 31, here.

to figure the credit

Go to Part IV on the

No

for you?

back now.

Part III

Other Information

2

If you had any nontaxable earned income (see page 62 of 1040A booklet or page EIC-2 of

1040 booklet) such as military housing and subsistence or contributions to a 401(k) plan,

enter the total of that income on line 2. Also, list type and amount here.

2

3

Enter the total amount you paid in 1992 for health insurance that covered at least one

qualifying child. (See page 63 of 1040A booklet or page EIC-2 of 1040 booklet.)

3

If you want the IRS to figure the credit for you,

STOP

!

Attach this schedule to your return. If filing Form 1040A, print “EIC” on the line next to line 28c.

If filing Form 1040, print “EIC” on the dotted line next to line 56.

For Paperwork Reduction Act Notice, see Form 1040A or 1040 instructions.

Schedule EIC (Form 1040A or 1040) 1992

Cat. No. 13339M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2