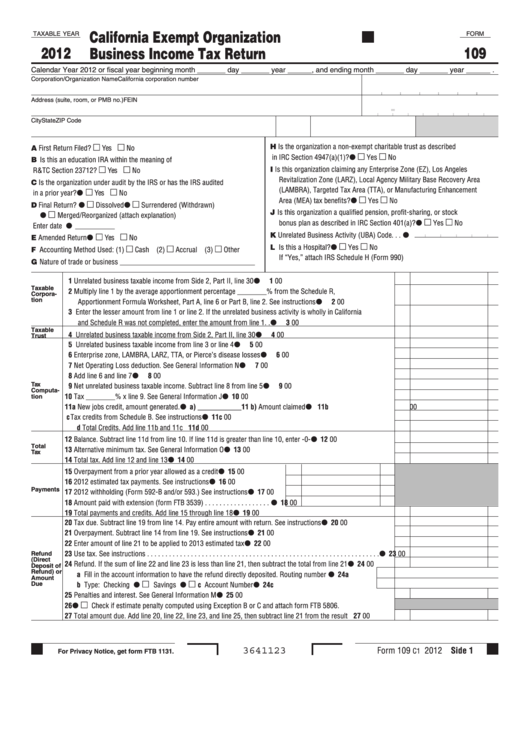

Form 109 - California Exempt Organization Business Income Tax Return - 2012

ADVERTISEMENT

California Exempt Organization

TAXABLE YEAR

FORM

2012

109

Business Income Tax Return

Calendar Year 2012 or fiscal year beginning month _______ day _______ year ______, and ending month _______ day _______ year ______ .

Corporation/Organization Name

California corporation number

Address (suite, room, or PMB no.)

FEIN

-

City

State

ZIP Code

H Is the organization a non-exempt charitable trust as described

A First Return Filed? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

in IRC Section 4947(a)(1)? . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

B Is this an education IRA within the meaning of

I Is this organization claiming any Enterprise Zone (EZ), Los Angeles

R&TC Section 23712? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Revitalization Zone (LARZ), Local Agency Military Base Recovery Area

C Is the organization under audit by the IRS or has the IRS audited

(LAMBRA), Targeted Tax Area (TTA), or Manufacturing Enhancement

in a prior year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Area (MEA) tax benefits? . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

D Final Return?

Dissolved

Surrendered (Withdrawn)

J Is this organization a qualified pension, profit-sharing, or stock

Merged/Reorganized (attach explanation)

bonus plan as described in IRC Section 401(a)? . . . . . . .

Yes

No

Enter date . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_____________

K Unrelated Business Activity (UBA) Code . . .

E Amended Return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

L Is this a Hospital? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

F Accounting Method Used: (1)

Cash (2)

Accrual (3)

Other

If “Yes,” attach IRS Schedule H (Form 990)

G Nature of trade or business _____________________________________

1 Unrelated business taxable income from Side 2, Part II, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

00

Taxable

2 Multiply line 1 by the average apportionment percentage ________% from the Schedule R,

Corpora-

tion

Apportionment Formula Worksheet, Part A, line 6 or Part B, line 2. See instructions . . . . . . . . . . . . . . . . . .

2

00

3 Enter the lesser amount from line 1 or line 2. If the unrelated business activity is wholly in California

and Schedule R was not completed, enter the amount from line 1. .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

Taxable

4 Unrelated business taxable income from Side 2, Part II, line 30 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

Trust

5 Unrelated business taxable income from line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Enterprise zone, LAMBRA, LARZ, TTA, or Pierce’s disease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Net Operating Loss deduction. See General Information N . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Add line 6 and line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

Tax

9 Net unrelated business taxable income. Subtract line 8 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

00

Computa-

10 Tax ________% x line 9. See General Information J . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

tion

11 a New jobs credit, amount generated. . . . . .

a) ____________ . . . . . 11 b) Amount claimed . . . . . . .

11b

00

c Tax credits from Schedule B. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11c

00

d Total Credits. Add line 11b and 11c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11d

00

12 Balance. Subtract line 11d from line 10. If line 11d is greater than line 10, enter -0-. . . . . . . . . . . . . . . . . . .

12

00

Total

13 Alternative minimum tax. See General Information O. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

Tax

14 Total tax. Add line 12 and line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

15 Overpayment from a prior year allowed as a credit . . . . . . . . . . . . . .

15

00

16 2012 estimated tax payments. See instructions. . . . . . . . . . . . . . . . .

16

00

Payments

17 2012 withholding (Form 592-B and/or 593.) See instructions . . . . . .

17

00

18 Amount paid with extension (form FTB 3539) . . . . . . . . . . . . . . . . . .

18

00

19 Total payments and credits. Add line 15 through line 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

00

20 Tax due. Subtract line 19 from line 14. Pay entire amount with return. See instructions . . . . . . . . . . . . . . . .

20

00

21 Overpayment. Subtract line 14 from line 19. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

00

22 Enter amount of line 21 to be applied to 2013 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Use tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

00

Refund

(Direct

24 Refund. If the sum of line 22 and line 23 is less than line 21, then subtract the total from line 21 . . . . . . . .

24

00

Deposit of

Refund) or

a Fill in the account information to have the refund directly deposited. Routing number . . . . . . . .

24a

Amount

Due

b Type: Checking

Savings

c Account Number . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24c

25 Penalties and interest. See General Information M. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

00

26

Check if estimate penalty computed using Exception B or C and attach form FTB 5806.

27 Total amount due. Add line 20, line 22, line 23, and line 25, then subtract line 21 from the result . . . . . . . . . . 27

00

Form 109

2012 Side 1

3641123

C1

For Privacy Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5