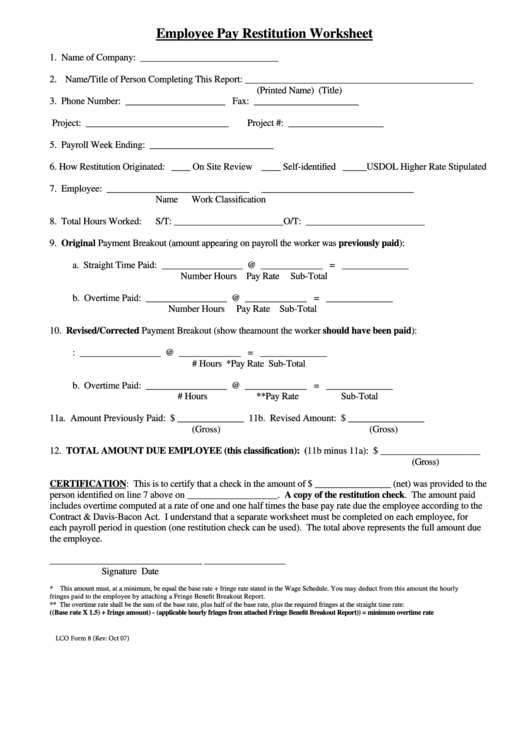

Employee Pay Restitution Worksheet

1. Name of Company: _____________________________

2. Name/Title of Person Completing This Report: ________________________________________________

(Printed Name)

(Title)

3. Phone Number: _____________________ Fax: ______________________

4. Name of Project: ______________________________

Project #: ____________________

5. Payroll Week Ending: __________________________

6. How Restitution Originated: ____ On Site Review ____ Self-identified _____USDOL Higher Rate Stipulated

7. Employee: ______________________________

________________________________

Name

Work Classification

8. Total Hours Worked:

S/T: _______________________ O/T: _________________________

9. Original Payment Breakout (amount appearing on payroll the worker was previously paid):

a. Straight Time Paid: _________________ @ _____________ = ______________

Number Hours

Pay Rate

Sub-Total

b. Overtime Paid: _________________ @ _____________ = ______________

Number Hours

Pay Rate

Sub-Total

10. Revised/Corrected Payment Breakout (show the amount the worker should have been paid):

a. Straight Time Paid: _________________ @ _____________ = ______________

# Hours

*Pay Rate

Sub-Total

b. Overtime Paid: _________________ @ _____________ = ______________

# Hours

**Pay Rate

Sub-Total

11a. Amount Previously Paid: $ ______________ 11b. Revised Amount: $ ________________

(Gross)

(Gross)

12. TOTAL AMOUNT DUE EMPLOYEE (this classification): (11b minus 11a): $ _____________________

(Gross)

CERTIFICATION: This is to certify that a check in the amount of $ ________________ (net) was provided to the

person identified on line 7 above on ___________________. A copy of the restitution check. The amount paid

includes overtime computed at a rate of one and one half times the base pay rate due the employee according to the

Contract & Davis-Bacon Act. I understand that a separate worksheet must be completed on each employee, for

each payroll period in question (one restitution check can be used). The total above represents the full amount due

the employee.

________________________________

_________________

Signature

Date

* This amount must, at a minimum, be equal the base rate + fringe rate stated in the Wage Schedule. You may deduct from this amount the hourly

fringes paid to the employee by attaching a Fringe Benefit Breakout Report.

** The overtime rate shall be the sum of the base rate, plus half of the base rate, plus the required fringes at the straight time rate:

((Base rate X 1.5) + fringe amount) - (applicable hourly fringes from attached Fringe Benefit Breakout Report)) = minimum overtime rate

LCO Form 8 (Rev: Oct 07)

1

1