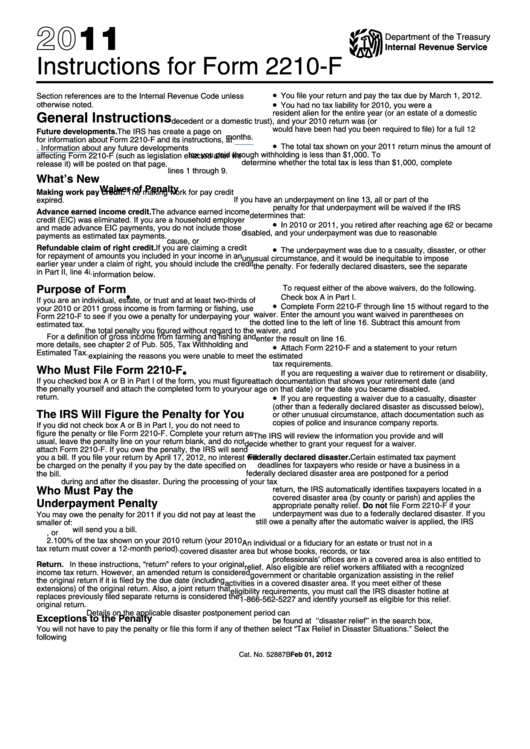

Instructions For Form 2210-F - Underpayment Of Estimated Tax By Farmers And Fishermen - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 2210-F

•

You file your return and pay the tax due by March 1, 2012.

Section references are to the Internal Revenue Code unless

•

otherwise noted.

You had no tax liability for 2010, you were a U.S. citizen or

resident alien for the entire year (or an estate of a domestic

General Instructions

decedent or a domestic trust), and your 2010 return was (or

would have been had you been required to file) for a full 12

Future developments. The IRS has create a page on IRS.gov

months.

for information about Form 2210-F and its instructions, at

www.

•

The total tax shown on your 2011 return minus the amount of

irs.gov/form2210. Information about any future developments

tax you paid through withholding is less than $1,000. To

affecting Form 2210-F (such as legislation enacted after we

determine whether the total tax is less than $1,000, complete

release it) will be posted on that page.

lines 1 through 9.

What’s New

Waiver of Penalty

Making work pay credit. The making work for pay credit

If you have an underpayment on line 13, all or part of the

expired.

penalty for that underpayment will be waived if the IRS

Advance earned income credit. The advance earned income

determines that:

credit (EIC) was eliminated. If you are a household employer

•

In 2010 or 2011, you retired after reaching age 62 or became

and made advance EIC payments, you do not include those

disabled, and your underpayment was due to reasonable

payments as estimated tax payments.

cause, or

Refundable claim of right credit. If you are claiming a credit

•

The underpayment was due to a casualty, disaster, or other

for repayment of amounts you included in your income in an

unusual circumstance, and it would be inequitable to impose

earlier year under a claim of right, you should include the credit

the penalty. For federally declared disasters, see the separate

in Part II, line 4i.

information below.

Purpose of Form

To request either of the above waivers, do the following.

•

Check box A in Part I.

If you are an individual, estate, or trust and at least two-thirds of

•

Complete Form 2210-F through line 15 without regard to the

your 2010 or 2011 gross income is from farming or fishing, use

waiver. Enter the amount you want waived in parentheses on

Form 2210-F to see if you owe a penalty for underpaying your

the dotted line to the left of line 16. Subtract this amount from

estimated tax.

the total penalty you figured without regard to the waiver, and

For a definition of gross income from farming and fishing and

enter the result on line 16.

more details, see chapter 2 of Pub. 505, Tax Withholding and

•

Attach Form 2210-F and a statement to your return

Estimated Tax.

explaining the reasons you were unable to meet the estimated

tax requirements.

Who Must File Form 2210-F

•

If you are requesting a waiver due to retirement or disability,

If you checked box A or B in Part I of the form, you must figure

attach documentation that shows your retirement date (and

the penalty yourself and attach the completed form to your

your age on that date) or the date you became disabled.

•

return.

If you are requesting a waiver due to a casualty, disaster

(other than a federally declared disaster as discussed below),

The IRS Will Figure the Penalty for You

or other unusual circumstance, attach documentation such as

copies of police and insurance company reports.

If you did not check box A or B in Part I, you do not need to

figure the penalty or file Form 2210-F. Complete your return as

The IRS will review the information you provide and will

usual, leave the penalty line on your return blank, and do not

decide whether to grant your request for a waiver.

attach Form 2210-F. If you owe the penalty, the IRS will send

Federally declared disaster. Certain estimated tax payment

you a bill. If you file your return by April 17, 2012, no interest will

be charged on the penalty if you pay by the date specified on

deadlines for taxpayers who reside or have a business in a

federally declared disaster area are postponed for a period

the bill.

during and after the disaster. During the processing of your tax

Who Must Pay the

return, the IRS automatically identifies taxpayers located in a

covered disaster area (by county or parish) and applies the

Underpayment Penalty

appropriate penalty relief. Do not file Form 2210-F if your

underpayment was due to a federally declared disaster. If you

You may owe the penalty for 2011 if you did not pay at least the

still owe a penalty after the automatic waiver is applied, the IRS

smaller of:

will send you a bill.

1. Two-thirds of the tax shown on your 2011 return, or

2. 100% of the tax shown on your 2010 return (your 2010

An individual or a fiduciary for an estate or trust not in a

tax return must cover a 12-month period).

covered disaster area but whose books, records, or tax

professionals’ offices are in a covered area is also entitled to

Return. In these instructions, “return” refers to your original

relief. Also eligible are relief workers affiliated with a recognized

income tax return. However, an amended return is considered

government or charitable organization assisting in the relief

the original return if it is filed by the due date (including

activities in a covered disaster area. If you meet either of these

extensions) of the original return. Also, a joint return that

eligibility requirements, you must call the IRS disaster hotline at

replaces previously filed separate returns is considered the

1-866-562-5227 and identify yourself as eligible for this relief.

original return.

Details on the applicable disaster postponement period can

Exceptions to the Penalty

be found at IRS.gov. Enter ‘‘disaster relief’’ in the search box,

You will not have to pay the penalty or file this form if any of the

then select “Tax Relief in Disaster Situations.” Select the

following applies.

federally declared disaster that affected you.

Feb 01, 2012

Cat. No. 52887B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2