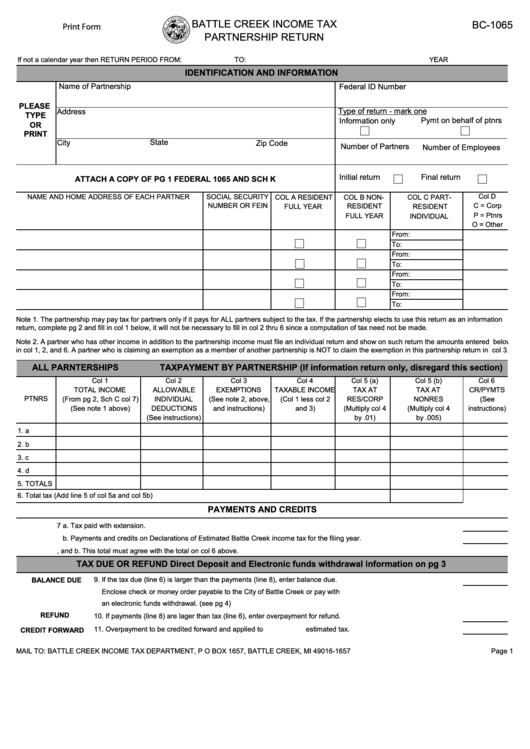

BATTLE CREEK INCOME TAX

BC-1065

Print Form

PARTNERSHIP RETURN

If not a calendar year then RETURN PERIOD FROM:

TO:

YEAR

IDENTIFICATION AND INFORMATION

Name of Partnership

Federal ID Number

PLEASE

Type of return - mark one

Address

TYPE

Pymt on behalf of ptnrs

Information only

OR

PRINT

State

City

Zip Code

Number of Partners

Number of Employees

Initial return

Final return

ATTACH A COPY OF PG 1 FEDERAL 1065 AND SCH K

Col D

NAME AND HOME ADDRESS OF EACH PARTNER

SOCIAL SECURITY

COL A RESIDENT

COL B NON-

COL C PART-

NUMBER OR FEIN

C = Corp

RESIDENT

FULL YEAR

RESIDENT

P = Ptnrs

FULL YEAR

INDIVIDUAL

O = Other

From:

To:

From:

To:

From:

To:

From:

To:

Note 1. The partnership may pay tax for partners only if it pays for ALL partners subject to the tax. If the partnership elects to use this return as an information

return, complete pg 2 and fill in col 1 below, it will not be necessary to fill in col 2 thru 6 since a computation of tax need not be made.

Note 2. A partner who has other income in addition to the partnership income must file an individual return and show on such return the amounts entered below

in col 1, 2, and 6. A partner who is claiming an exemption as a member of another partnership is NOT to claim the exemption in this partnership return in col 3.

ALL PARNTERSHIPS

TAXPAYMENT BY PARTNERSHIP (If information return only, disregard this section)

Col 1

Col 2

Col 3

Col 4

Col 5 (a)

Col 5 (b)

Col 6

TOTAL INCOME

ALLOWABLE

EXEMPTIONS

TAXABLE INCOME

TAX AT

TAX AT

CR/PYMTS

PTNRS

(From pg 2, Sch C col 7)

INDIVIDUAL

(See note 2, above,

(Col 1 less col 2

RES/CORP

NONRES

(See

(See note 1 above)

DEDUCTIONS

and instructions)

and 3)

(Multiply col 4

(Multiply col 4

instructions)

(See instructions)

by .01)

by .005)

1. a

2. b

3. c

4. d

5. TOTALS

6. Total tax (Add line 5 of col 5a and col 5b)

PAYMENTS AND CREDITS

7 a. Tax paid with extension.

b. Payments and credits on Declarations of Estimated Battle Creek income tax for the filing year.

8.Total - add lines 7a, and b. This total must agree with the total on col 6 above.

TAX DUE OR REFUND Direct Deposit and Electronic funds withdrawal information on pg 3

BALANCE DUE

9. If the tax due (line 6) is larger than the payments (line 8), enter balance due.

Enclose check or money order payable to the City of Battle Creek or pay with

an electronic funds withdrawal. (see pg 4)

REFUND

10. If payments (line 8) are lager than tax (line 6), enter overpayment for refund.

11. Overpayment to be credited forward and applied to

estimated tax.

CREDIT FORWARD

MAIL TO: BATTLE CREEK INCOME TAX DEPARTMENT, P O BOX 1657, BATTLE CREEK, MI 49016-1657

Page 1

1

1 2

2 3

3 4

4