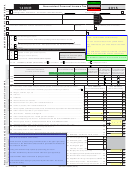

Form 140nr - Nonresident Personal Income Tax Return - 1999 Page 2

ADVERTISEMENT

Form 140NR (1999) Page 2

PART A

A1

List children and other dependents. If more space is needed, attach a separate sheet.

Dependents

No. of months

First name

Last name

Social security number

Relationship

lived in your home

in 1999

Do not list

yourself or

spouse.

A2

TOTAL

A2

Enter total number of persons listed in A1 here and on the front of this form, box 10.

A3

Enter the names of the dependents age 65 or over listed above who do not qualify as your dependent on your federal return:

1999 FEDERAL

PART B

1999 ARIZONA

Amounts from federal return

Source amounts

Arizona

Percent of

B4

Wages, salaries, tips, etc. ....................................................................................................

B4

00

00

Total

B5

Interest .................................................................................................................................

00

00

B5

Income

00

00

B6

Dividends .............................................................................................................................

B6

B7

Arizona income tax refunds .................................................................................................

00

00

B7

00

00

B8

Business income or (loss) from federal Schedule C ...........................................................

B8

B9

Gains or (losses) from federal Schedule D..........................................................................

00

00

B9

B10 Rents, royalties, partnerships, estates, trusts, small business corporations from

00

federal Schedule E

B10

00

B11 Other income reported on your federal return .....................................................................

00

00

B11

B12 Total income. Add lines B4 through B11 ...........................................................................

00

00

B12

00

B13 Other federal adjustments. Attach your own schedule ........................................................

B13

00

00

B14

B14 Federal adjusted gross income. Subtract line B13 from line B12 in FEDERAL Column .

B15 Arizona income. Subtract line B13 from line B12 in ARIZONA Column. Enter

B15

00

here and on the front of this form on line 15 ......................................................................................................................

%

B16

B16 Arizona percentage. Divide line B15 by line B14 and enter the result (not over 100%) ..................................................

C17 Early withdrawal of Arizona Retirement System contributions ..........................................................................................

C17

PART C

00

C18 Other additions to income. See instructions and attach your own schedule .....................................................................

Additions

C18

00

C19 Total. Add lines C17 and C18. Enter here and on the front of this form, line 16................................................................

To Income

C19

00

D20 Exemption: Age 65 or over. Multiply number in box 8, page 1, by $2,100 ........................

D20

00

PART D

D21 Exemption: Blind. Multiply number in box 9, page 1, by $1,500 .........................................

D21

00

Subtractions

D22

D22 Exemption: Dependents. Multiply number in box 10, page 1, by $2,300 ............................

00

From

D23

D23 Total exemptions. Add lines D20 through D22 ....................................................................

00

Income

D24 Multiply line D23 by percentage on line B16 and enter the result......................................................................................

D24

00

D25 Interest on U.S. obligations, such as U.S. savings bonds and treasury bills included in the ARIZONA column ..............

D25

00

D26 Arizona state lottery winnings included on line B11 in ARIZONA column (up to $5,000 only) ..........................................

D26

00

D27 Alternative fuel vehicles and refueling equipment .............................................................................................................

D27

00

D28 Agricultural crops contributed to Arizona charitable organizations ....................................................................................

D28

00

D29 Other subtractions. See instructions and attach your own schedule ................................................................................

D29

00

D30 Total. Add lines D24 through D29. Enter here and on the front of this form, line 18..........................................................

D30

00

E31 Last name(s) used in prior years if different from name(s) used in current year.

PART E

I have read this return and any attachments with it. Under penalties of perjury, I declare that to the best of my knowledge and belief, they are true, correct and complete.

Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Occupation

Please

Sign

Spouse's occupation

Spouse's signature

Date

Here

Firm's name (preparer's if self-employed)

Preparer's signature

Paid

Preparer's

Preparer's TIN

Preparer's address

Information

Date

If you are sending a payment with this return, mail to: Arizona Department of Revenue, PO Box 52016, Phoenix AZ 85072-2016.

If you are expecting a refund, or owe no tax, or owe tax but are not sending a payment, mail to: Arizona Department of Revenue, PO Box 52138, Phoenix AZ 85072-2138.

ADOR 06-0080 (99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2