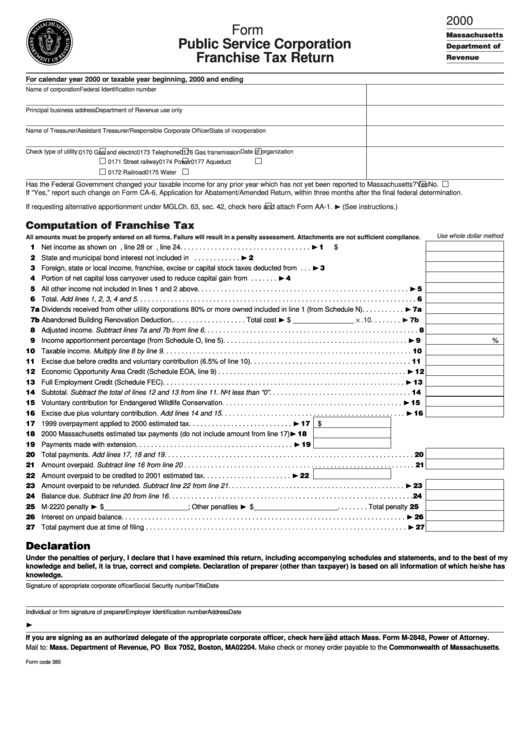

Form P.s.1 - Public Service Corporation Franchise Tax Return - 2000

ADVERTISEMENT

2000

Form P.S.1

Massachusetts

Public Service Corporation

Department of

Franchise Tax Return

Revenue

For calendar year 2000 or taxable year beginning

, 2000 and ending

Name of corporation

Federal Identification number

Principal business address

Department of Revenue use only

Name of Treasurer/Assistant Treasurer/Responsible Corporate Officer

State of incorporation

Check type of utility:

Date of organization

0170 Gas and electric

0173 Telephone

0176 Gas transmission

0171 Street railway

0174 Power

0177 Aqueduct

0172 Railroad

0175 Water

Has the Federal Government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

If “Yes,” report such change on Form CA-6, Application for Abatement/Amended Return, within three months after the final federal determination.

and attach Form AA-1. ❿!(See instructions.)

If requesting alternative apportionment under MGL Ch. 63, sec. 42, check here

Computation of Franchise Tax

Use whole dollar method

All amounts must be properly entered on all forms. Failure will result in a penalty assessment. Attachments are not sufficient compliance.

11 Net income as shown on U.S. Form 1120, line 28 or U.S. Form 1120A, line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 1

$

12 State and municipal bond interest not included in U.S. net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

13 Foreign, state or local income, franchise, excise or capital stock taxes deducted from U.S. net income . . . . . . . . . . . . . . . . ❿ 3

14 Portion of net capital loss carryover used to reduce capital gain from U.S. Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 4

15 All other income not included in lines 1 and 2 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 5

16 Total. Add lines 1, 2, 3, 4 and 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17a Dividends received from other utility corporations 80% or more owned included in line 1 (from Schedule N) . . . . . . . . . . . ❿ 7a

× .10 . . . . . . . . ❿ 7b

17b Abandoned Building Renovation Deduction. . . . . . . . . . . . . . . . . . . . Total cost ❿ $ ________________

18 Adjusted income. Subtract lines 7a and 7b from line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Income apportionment percentage (from Schedule O, line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9

%

10 Taxable income. Multiply line 8 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Excise due before credits and voluntary contribution (6.5% of line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Economic Opportunity Area Credit (Schedule EOA, line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 12

13 Full Employment Credit (Schedule FEC) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 13

14 Subtotal. Subtract the total of lines 12 and 13 from line 11. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Voluntary contribution for Endangered Wildlife Conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 15

16 Excise due plus voluntary contribution. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 16

17 1999 overpayment applied to 2000 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 17

$

18 2000 Massachusetts estimated tax payments (do not include amount from line 17) ❿ 18

19 Payments made with extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 19

20 Total payments. Add lines 17, 18 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Amount overpaid. Subtract line 16 from line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Amount overpaid to be credited to 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . ❿ 22

23 Amount overpaid to be refunded. Subtract line 22 from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 23

24 Balance due. Subtract line 20 from line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 M-2220 penalty ❿ $______________________ ; Other penalties ❿ $ ______________________ . . . . . . . . Total penalty 25

26 Interest on unpaid balance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 26

27 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 27

Declaration

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has

knowledge.

Signature of appropriate corporate officer

Social Security number

Title

Date

Individual or firm signature of preparer

Employer Identification number

Address

Date

❿

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and attach Mass. Form M-2848, Power of Attorney.

Mail to: Mass. Department of Revenue, PO Box 7052, Boston, MA 02204. Make check or money order payable to the Commonwealth of Massachusetts.

Form code 385

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2