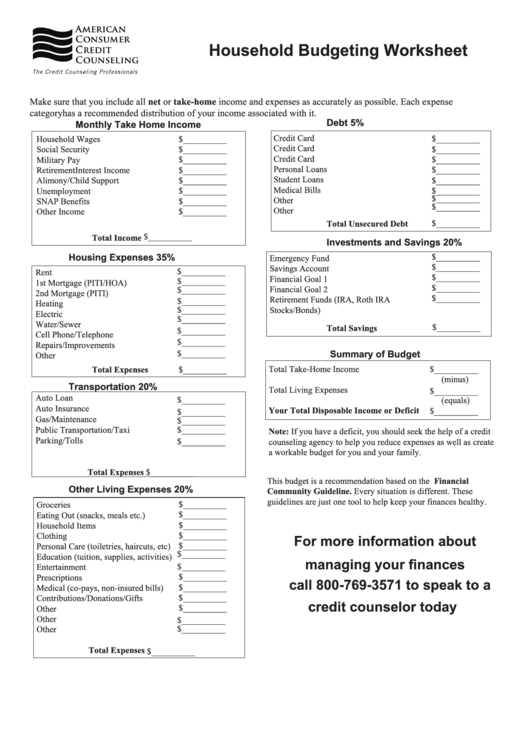

Household Budgeting Worksheet

ADVERTISEMENT

Household Budgeting Worksheet

Make sure that you include all net or take-home income and expenses as accurately as possible. Each expense

category has a recommended distribution of your income associated with it.

Debt 5%

Monthly Take Home Income

Credit Card

$__________

$__________

Household Wages

Credit Card

$__________

Social Security

$__________

Credit Card

$__________

Military Pay

$__________

Personal Loans

Retirement Interest Income

$__________

$__________

Student Loans

$__________

$__________

Alimony/Child Support

Medical Bills

$__________

Unemployment

$__________

$__________

Other

SNAP Benefits

$__________

$__________

Other

Other Income

$__________

$__________

Total Unsecured Debt

$__________

Total Income

Investments and Savings 20%

Housing Expenses 35%

$__________

Emergency Fund

$__________

Savings Account

$__________

Rent

$__________

Financial Goal 1

$__________

1st Mortgage (PITI/HOA)

$__________

Financial Goal 2

$__________

2nd Mortgage (PITI)

$__________

Retirement Funds (IRA, Roth IRA

$__________

Heating

$__________

Stocks/Bonds)

Electric

$__________

Water/Sewer

$__________

Total Savings

$__________

Cell Phone/Telephone

$__________

Repairs/Improvements

$__________

Summary of Budget

Other

Total Expenses

$__________

Total Take-Home Income

$__________

(minus)

Transportation 20%

Total Living Expenses

$__________

Auto Loan

$__________

(equals)

Auto Insurance

Your Total Disposable Income or Deficit

$__________

$__________

Gas/Maintenance

$__________

Public Transportation/Taxi

$__________

Note: If you have a deficit, you should seek the help of a credit

Parking/Tolls

$__________

counseling agency to help you reduce expenses as well as create

a workable budget for you and your family.

Total Expenses

$__________

This budget is a recommendation based on the Financial

Other Living Expenses 20%

Community Guideline. Every situation is different. These

guidelines are just one tool to help keep your finances healthy.

$__________

Groceries

$__________

Eating Out (snacks, meals etc.)

$__________

Household Items

$__________

Clothing

For more information about

$__________

Personal Care (toiletries, haircuts, etc)

$__________

Education (tuition, supplies, activities)

managing your finances

$__________

Entertainment

$__________

Prescriptions

call 800-769-3571 to speak to a

$__________

Medical (co-pays, non-insured bills)

$__________

Contributions/Donations/Gifts

credit counselor today

$__________

Other

Other

$__________

$__________

Other

Total Expenses

$__________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1