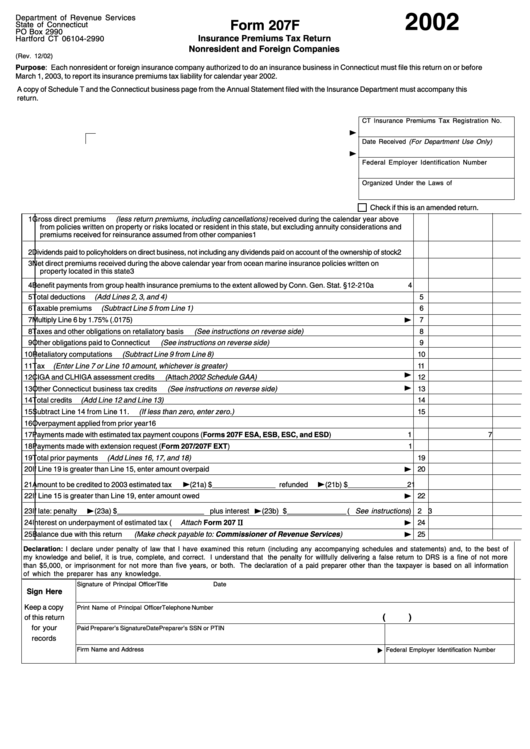

Form 207f - Insurance Premiums Tax Return Nonresident And Foreign Companies - 2002

ADVERTISEMENT

2002

Department of Revenue Services

Form 207F

State of Connecticut

PO Box 2990

Insurance Premiums Tax Return

Hartford CT 06104-2990

Nonresident and Foreign Companies

(Rev. 12/02)

Purpose: Each nonresident or foreign insurance company authorized to do an insurance business in Connecticut must file this return on or before

March 1, 2003, to report its insurance premiums tax liability for calendar year 2002.

A copy of Schedule T and the Connecticut business page from the Annual Statement filed with the Insurance Department must accompany this

return.

CT Insurance Premiums Tax Registration No.

Date Received (For Department Use Only)

Federal Employer Identification Number

Organized Under the Laws of

Check if this is an amended return.

1 Gross direct premiums (less return premiums, including cancellations) received during the calendar year above

from policies written on property or risks located or resident in this state, but excluding annuity considerations and

premiums received for reinsurance assumed from other companies

1

2 Dividends paid to policyholders on direct business, not including any dividends paid on account of the ownership of stock

2

3 Net direct premiums received during the above calendar year from ocean marine insurance policies written on

property located in this state

3

4 Benefit payments from group health insurance premiums to the extent allowed by Conn. Gen. Stat. §12-210a

4

5 Total deductions (Add Lines 2, 3, and 4)

5

6 Taxable premiums (Subtract Line 5 from Line 1)

6

7 Multiply Line 6 by 1.75% (.0175)

7

8 Taxes and other obligations on retaliatory basis (See instructions on reverse side)

8

9 Other obligations paid to Connecticut (See instructions on reverse side)

9

Retaliatory computations (Subtract Line 9 from Line 8)

10

10

11

Tax (Enter Line 7 or Line 10 amount, whichever is greater)

11

12

CIGA and CLHIGA assessment credits ( Attach 2002 Schedule GAA)

12

13

Other Connecticut business tax credits (See instructions on reverse side)

13

14

Total credits (Add Line 12 and Line 13)

14

15

Subtract Line 14 from Line 11. (If less than zero, enter zero.)

15

16

Overpayment applied from prior year

16

17

Payments made with estimated tax payment coupons (Forms 207F ESA, ESB, ESC, and ESD)

17

18

Payments made with extension request (Form 207/207F EXT)

18

19

Total prior payments (Add Lines 16, 17, and 18)

19

20

If Line 19 is greater than Line 15, enter amount overpaid

20

21

Amount to be credited to 2003 estimated tax

(21a) $ ________________ refunded

(21b) $ _______________ 21

22

If Line 15 is greater than Line 19, enter amount owed

22

23

If late: penalty

(23a) $ ______________________ plus interest

(23b) $ _______________ ( See instructions ) 23

I I I I I )

24

Interest on underpayment of estimated tax ( Attach Form 207

24

25

Balance due with this return (Make check payable to: Commissioner of Revenue Services)

25

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more

than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information

of which the preparer has any knowledge.

Signature of Principal Officer

Title

Date

Sign Here

Keep a copy

Print Name of Principal Officer

Telephone Number

(

)

of this return

for your

Paid Preparer’s Signature

Date

Preparer’s SSN or PTIN

records

Firm Name and Address

Federal Employer Identification Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1