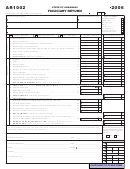

Form Ar1002 - Fiduciary Return - 2000 Page 2

ADVERTISEMENT

Schedule A: Capital Gains Worksheet (Attach Federal Schedule D, Form 1041)

Complete this worksheet only if you have a NET CAPITAL GAIN reported on Federal Schedule

D, Form 1041.

1. Enter the Net Long-Term Capital Gain reported on Line 13, Federal Schedule D,

00

Form 1041 .....................................................................................................................................................................

2. Enter the Net Short-Term Capital Loss, if any, reported on Line 5, Federal Schedule D,

00

Form 1041, otherwise enter zero (0) .............................................................................................................................

00

3. Net Capital Gain: (Subtract Line 2 from Line 1) ............................................................................................................

00

4. Taxable Amount: [Multiply Line 3 by 70 percent (.70)] ..................................................................................................

5. Enter the Net Short-Term Capital Gain, if any, reported on Line 5, Federal Schedule D,

00

Form 1041, otherwise enter zero (0) .............................................................................................................................

6. Total Taxable Capital Gains: (Add Lines 4 and 5. Enter the result here and on

00

Line 4, AR1002/1002NR) ..............................................................................................................................................

Schedule B: Income Distribution (Attach Federal K-1’s)

Beneficiaries’ share of income: ____________________________

Number of beneficiaries to receive distribution: _________________

FIRST NAME

MI

LAST NAME

SSN

ADDRESS

ST

ZIP

AMOUNT

00

00

00

00

00

00

00

00

00

00

Mail TAX DUE to: State Income Tax, P. O. Box 2144, LIttle Rock, AR 72203-2144

Mail AMENDED to:

State Income Tax, P. O. Box 3628, LIttle Rock, AR 72203-3628

Mail REFUND to: State Income Tax, P. O. Box 1000, LIttle Rock, AR 72203-1000

Mail NO TAX DUE to: State Income Tax, P. O. Box 8026, LIttle Rock, AR 72203-8026

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2