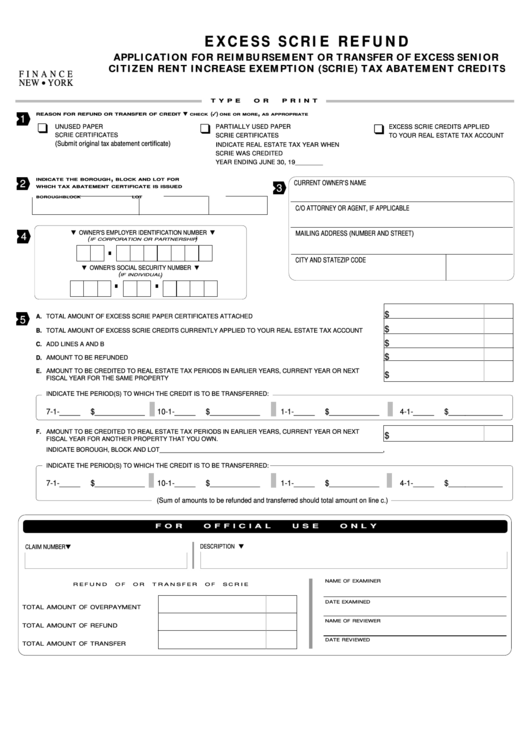

E X C E S S S C R I E R E F U N D

APPLICATION FOR REIMBURSEMENT OR TRANSFER OF EXCESS SENIOR

CITIZEN RENT INCREASE EXEMPTION (SCRIE) TAX ABATEMENT CREDITS

F I N A N C E

NEW YORK

T Y P E

O R

P R I N T

,

( )

REASON FOR REFUND OR TRANSFER OF CREDIT

CHECK

ONE OR MORE

AS APPROPRIATE

1

UNUSED PAPER

PARTIALLY USED PAPER

EXCESS SCRIE CREDITS APPLIED

SCRIE CERTIFICATES

SCRIE CERTIFICATES

TO YOUR REAL ESTATE TAX ACCOUNT

(Submit original tax abatement certificate)

INDICATE REAL ESTATE TAX YEAR WHEN

SCRIE WAS CREDITED

YEAR ENDING JUNE 30, 19

_________

,

INDICATE THE BOROUGH

BLOCK AND LOT FOR

2

CURRENT OWNER'S NAME

3

WHICH TAX ABATEMENT CERTIFICATE IS ISSUED

BOROUGH

BLOCK

LOT

C/O ATTORNEY OR AGENT, IF APPLICABLE

OWNER'S EMPLOYER IDENTIFICATION NUMBER

MAILING ADDRESS (NUMBER AND STREET)

4

(

)

IF CORPORATION OR PARTNERSHIP

CITY AND STATE

ZIP CODE

OWNER'S SOCIAL SECURITY NUMBER

(

)

IF INDIVIDUAL

$

A. TOTAL AMOUNT OF EXCESS SCRIE PAPER CERTIFICATES ATTACHED

....................................................................................................

5

$

B. TOTAL AMOUNT OF EXCESS SCRIE CREDITS CURRENTLY APPLIED TO YOUR REAL ESTATE TAX ACCOUNT

..........

$

C. ADD LINES A AND B

....................................................................................................................................................................................................

$

D. AMOUNT TO BE REFUNDED ..........................................................................................................................................................

E. AMOUNT TO BE CREDITED TO REAL ESTATE TAX PERIODS IN EARLIER YEARS, CURRENT YEAR OR NEXT

$

FISCAL YEAR FOR THE SAME PROPERTY..................................................................................................................................

INDICATE THE PERIOD(S) TO WHICH THE CREDIT IS TO BE TRANSFERRED:

7-1-_____

$____________

10-1-_____

$____________

1-1-_____

$____________

4-1-_____

$_____________

F. AMOUNT TO BE CREDITED TO REAL ESTATE TAX PERIODS IN EARLIER YEARS, CURRENT YEAR OR NEXT

$

FISCAL YEAR FOR ANOTHER PROPERTY THAT YOU OWN. ..................................................................................................

INDICATE BOROUGH, BLOCK AND LOT_____________________________________________________________________,

INDICATE THE PERIOD(S) TO WHICH THE CREDIT IS TO BE TRANSFERRED:

7-1-_____

$____________

10-1-_____

$____________

1-1-_____

$____________

4-1-_____

$_____________

(Sum of amounts to be refunded and transferred should total amount on line c.)

F O R

O F F I C I A L

U S E

O N L Y

DESCRIPTION

CLAIM NUMBER

NAME OF EXAMINER

R E F U N D

O F

O R

T R A N S F E R

O F

S C R I E

DATE EXAMINED

TOTAL AMOUNT OF OVERPAYMENT

.......

NAME OF REVIEWER

TOTAL AMOUNT OF REFUND

.......................

DATE REVIEWED

TOTAL AMOUNT OF TRANSFER

.................

1

1 2

2