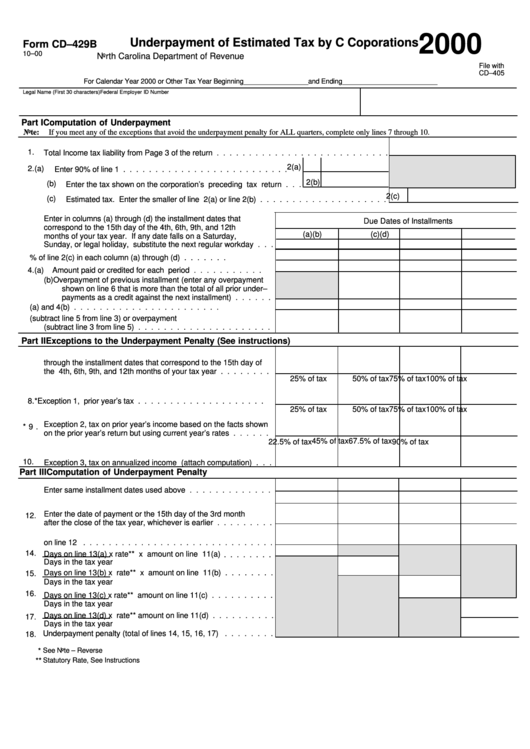

Form Cd-429b - Underpaiment Of Estimated Tax By C Coporations - 2000

ADVERTISEMENT

2000

Underpayment of Estimated Tax by C Coporations

Form CD–429B

10–00

North Carolina Department of Revenue

File with

CD–405

For Calendar Year 2000 or Other Tax Year Beginning_________________and Ending_________________________

Legal Name (First 30 characters)

Federal Employer ID Number

Part I Computation of Underpayment

Note:

If you meet any of the exceptions that avoid the underpayment penalty for ALL quarters, complete only lines 7 through 10.

1.

Total Income tax liability from Page 3 of the return . . . . . . . . . . . . . . . . . . . . . . . . . . .

2(a)

2.

(a)

Enter 90% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . .

2(b)

(b)

Enter the tax shown on the corporation’s preceding tax return . . .

2(c)

(c)

Estimated tax. Enter the smaller of line 2(a) or line 2(b) . . . . . . . . . . . . . . . . . . . .

Enter in columns (a) through (d) the installment dates that

Due Dates of Installments

correspond to the 15th day of the 4th, 6th, 9th, and 12th

(a)

(b)

(c)

(d)

months of your tax year. If any date falls on a Saturday,

Sunday, or legal holiday, substitute the next regular workday . . .

3.

Enter 25% of line 2(c) in each column (a) through (d) . . . . . . .

4.

(a)

Amount paid or credited for each period . . . . . . . . . . .

(b)

Overpayment of previous installment (enter any overpayment

shown on line 6 that is more than the total of all prior under–

payments as a credit against the next installment) . . . . . .

5.

Add lines 4(a) and 4(b) . . . . . . . . . . . . . . . . . . . . . . .

6. Underpayment (subtract line 5 from line 3) or overpayment

(subtract line 3 from line 5) . . . . . . . . . . . . . . . . . . . . .

Part II Exceptions to the Underpayment Penalty (See instructions)

7.

Total amount paid or credited from the beginning of the tax year

through the installment dates that correspond to the 15th day of

the 4th, 6th, 9th, and 12th months of your tax year . . . . . . . .

25% of tax

50% of tax

75% of tax

100% of tax

*

8.

Exception 1, prior year’s tax . . . . . . . . . . . . . . . . . . . .

25% of tax

50% of tax

75% of tax

100% of tax

Exception 2, tax on prior year’s income based on the facts shown

* 9.

on the prior year’s return but using current year’s rates . . . . . .

45% of tax

67.5% of tax

22.5% of tax

90% of tax

10.

Exception 3, tax on annualized income (attach computation) . . .

Part III Computation of Underpayment Penalty

Enter same installment dates used above . . . . . . . . . . . . .

11. Amount of underpayment from line 6 . . . . . . . . . . . . . . . .

12. Enter the date of payment or the 15th day of the 3rd month

after the close of the tax year, whichever is earlier . . . . . . . . .

13. Number of days from due date of installment to the date shown

on line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Days on line 13(a) x rate** x amount on line 11(a)

. . . . . . . .

Days in the tax year

15. Days on line 13(b) x rate** x amount on line 11(b) . . . . . . . .

Days in the tax year

16. Days on line 13(c) x rate** amount on line 11(c) . . . . . . . . . .

Days in the tax year

Days on line 13(d) x rate** amount on line 11(d) . . . . . . . . . .

17.

Days in the tax year

18. Underpayment penalty (total of lines 14, 15, 16, 17) . . . . . . . .

See Note – Reverse

*

**

Statutory Rate, See Instructions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2