Form 943 - Request For Tax Clearance

ADVERTISEMENT

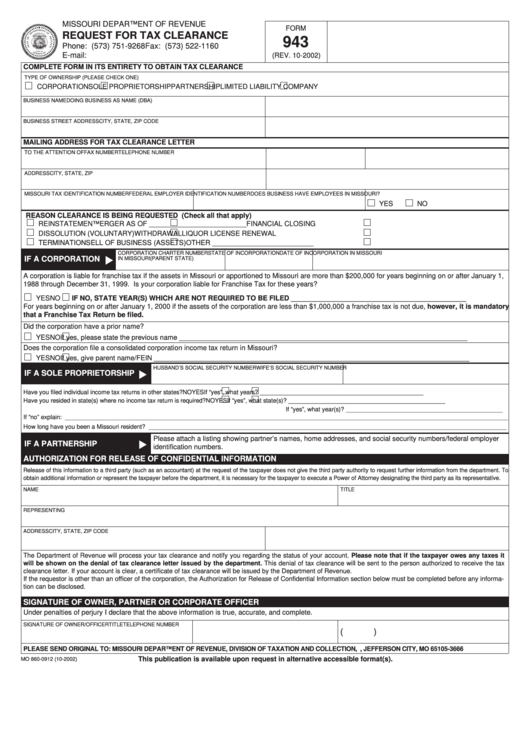

MISSOURI DEPARTMENT OF REVENUE

FORM

REQUEST FOR TAX CLEARANCE

943

Phone: (573) 751-9268

Fax: (573) 522-1160

E-mail: taxclearance@mail.dor.state.mo.us

(REV. 10-2002)

COMPLETE FORM IN ITS ENTIRETY TO OBTAIN TAX CLEARANCE

TYPE OF OWNERSHIP (PLEASE CHECK ONE)

CORPORATION

SOLE PROPRIETORSHIP

PARTNERSHIP

LIMITED LIABILITY COMPANY

BUSINESS NAME

DOING BUSINESS AS NAME (DBA)

BUSINESS STREET ADDRESS

CITY, STATE, ZIP CODE

MAILING ADDRESS FOR TAX CLEARANCE LETTER

TO THE ATTENTION OF

FAX NUMBER

TELEPHONE NUMBER

ADDRESS

CITY, STATE, ZIP

MISSOURI TAX IDENTIFICATION NUMBER

FEDERAL EMPLOYER IDENTIFICATION NUMBER

DOES BUSINESS HAVE EMPLOYEES IN MISSOURI?

YES

NO

REASON CLEARANCE IS BEING REQUESTED (Check all that apply)

REINSTATEMENT

MERGER AS OF _________________________

FINANCIAL CLOSING

DISSOLUTION (VOLUNTARY)

WITHDRAWAL

LIQUOR LICENSE RENEWAL

TERMINATION

SELL OF BUSINESS (ASSETS)

OTHER __________________________

CORPORATION CHARTER NUMBER

STATE OF INCORPORATION

DATE OF INCORPORATION IN MISSOURI

IF A CORPORATION

IN MISSOURI

(PARENT STATE)

A corporation is liable for franchise tax if the assets in Missouri or apportioned to Missouri are more than $200,000 for years beginning on or after January 1,

1988 through December 31, 1999. Is your corporation liable for Franchise Tax for these years?

YES

NO

IF NO, STATE YEAR(S) WHICH ARE NOT REQUIRED TO BE FILED _____________________________________________

For years beginning on or after January 1, 2000 if the assets of the corporation are less than $1,000,000 a franchise tax is not due, however, it is mandatory

that a Franchise Tax Return be filed.

Did the corporation have a prior name?

YES

NO

If yes, please state the previous name __________________________________________________________________________

Does the corporation file a consolidated corporation income tax return in Missouri?

YES

NO

If yes, give parent name/FEIN _________________________________________________________________________________

HUSBAND’S SOCIAL SECURITY NUMBER

WIFE’S SOCIAL SECURITY NUMBER

IF A SOLE PROPRIETORSHIP

Have you filed individual income tax returns in other states?

NO

YES

If “yes”, what years? ________________________________________________

Have you resided in state(s) where no income tax return is required?

NO

YES

If “yes”, what state(s)? ______________________________________________

If “yes”, what year(s)? ______________________________________________

If “no” explain: __________________________________________________________________________________________________________________________________

How long have you been a Missouri resident? _________________________________________________________________________________________________________

Please attach a listing showing partner’s names, home addresses, and social security numbers/federal employer

IF A PARTNERSHIP

identification numbers.

AUTHORIZATION FOR RELEASE OF CONFIDENTIAL INFORMATION

Release of this information to a third party (such as an accountant) at the request of the taxpayer does not give the third party authority to request further information from the department. To

obtain additional information or represent the taxpayer before the department, it is necessary for the taxpayer to execute a Power of Attorney designating the third party as its representative.

NAME

TITLE

REPRESENTING

ADDRESS

CITY, STATE, ZIP CODE

The Department of Revenue will process your tax clearance and notify you regarding the status of your account. Please note that if the taxpayer owes any taxes it

will be shown on the denial of tax clearance letter issued by the department. This denial of tax clearance will be sent to the person authorized to receive the tax

clearance letter. If your account is clear, a certificate of tax clearance will be issued by the Department of Revenue.

If the requestor is other than an officer of the corporation, the Authorization for Release of Confidential Information section below must be completed before any informa-

tion can be disclosed.

SIGNATURE OF OWNER, PARTNER OR CORPORATE OFFICER

Under penalties of perjury I declare that the above information is true, accurate, and complete.

SIGNATURE OF OWNER/OFFICER

TITLE

TELEPHONE NUMBER

(

)

PLEASE SEND ORIGINAL TO: MISSOURI DEPARTMENT OF REVENUE, DIVISION OF TAXATION AND COLLECTION, P.O. BOX 3666, JEFFERSON CITY, MO 65105-3666

This publication is available upon request in alternative accessible format(s).

MO 860-0912 (10-2002)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1