Form Dr 0021s Draft - Extension Payment Voucher For Colorado Oil And Gas Severance Tax Return - 2010

ADVERTISEMENT

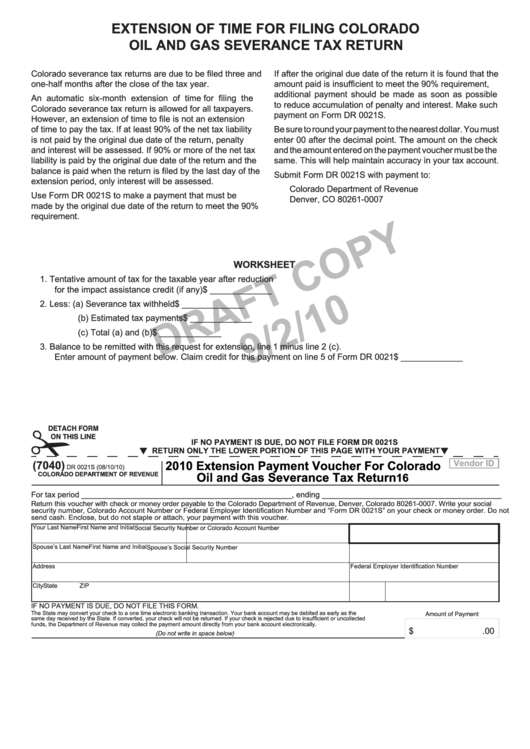

EXTENSION OF TIME FOR FILING COLORADO

OIL AND GAS SEVERANCE TAX RETURN

Colorado severance tax returns are due to be filed three and

If after the original due date of the return it is found that the

one-half months after the close of the tax year.

amount paid is insufficient to meet the 90% requirement,

additional payment should be made as soon as possible

An automatic six-month extension of time for filing the

to reduce accumulation of penalty and interest. Make such

Colorado severance tax return is allowed for all taxpayers.

payment on Form DR 0021S.

However, an extension of time to file is not an extension

of time to pay the tax. If at least 90% of the net tax liability

Be sure to round your payment to the nearest dollar. You must

is not paid by the original due date of the return, penalty

enter 00 after the decimal point. The amount on the check

and interest will be assessed. If 90% or more of the net tax

and the amount entered on the payment voucher must be the

liability is paid by the original due date of the return and the

same. This will help maintain accuracy in your tax account.

balance is paid when the return is filed by the last day of the

Submit Form DR 0021S with payment to:

extension period, only interest will be assessed.

Colorado Department of Revenue

Use Form DR 0021S to make a payment that must be

Denver, CO 80261-0007

made by the original due date of the return to meet the 90%

requirement.

WORKShEET

1. Tentative amount of tax for the taxable year after reduction

for the impact assistance credit (if any) .............................................................................................$ _____________

2. Less: (a) Severance tax withheld .......................................................................................................$ _____________

(b) Estimated tax payments .....................................................................................................$ _____________

(c) Total (a) and (b) ...................................................................................................................$ _____________

3. Balance to be remitted with this request for extension, line 1 minus line 2 (c).

Enter amount of payment below. Claim credit for this payment on line 5 of Form DR 0021 .............$ _____________

DETACH FORM

ON THIS LINE

IF NO PAYMENT IS DUE, DO NOT FILE FORM DR 0021S

RETURN ONLY ThE LOWER PORTION OF ThIS PAGE WITh YOUR PAYMENT

(7040)

2010 Extension Payment Voucher For Colorado

Vendor ID

DR 0021S (08/10/10)

Oil and Gas Severance Tax Return

COLORADO DEPARTMENT OF REVENUE

16

For tax period ________________________________________________, ending _________________________________________

Return this voucher with check or money order payable to the Colorado Department of Revenue, Denver, Colorado 80261-0007. Write your social

security number, Colorado Account Number or Federal Employer Identification Number and “Form DR 0021S” on your check or money order. Do not

send cash. Enclose, but do not staple or attach, your payment with this voucher

.

Your Last Name

First Name and Initial

Social Security Number or Colorado Account Number

Spouse’s Last Name

First Name and Initial

Spouse’s Social Security Number

Address

Federal Employer Identification Number

City

State

ZIP

IF NO PAYMENT IS DUE, DO NOT FILE THIS FORM.

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the

Amount of Payment

same day received by the State. If converted, your check will not be returned. If your check is rejected due to insufficient or uncollected

funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

$

.00

(Do not write in space below)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1