Form Dr 142 - Solid Mineral Severance Tax Return - 2003 Page 2

ADVERTISEMENT

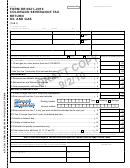

DR-142

R. 04/03

Page 2

SCHEDULE I - Production of Phosphate Rock

1.

Enter tons produced in county of production in the table below. Use blank spaces for counties not listed.

County

Tons Produced

County

Tons Produced

Hamilton

Polk

Hardee

Hillsborough

Manatee

2.

Enter total tons produced here and on line 1, column A on front of form.

2.

❏

❏

3.

Did your company donate property to a county in which it had phosphate rock production?

Yes

No

(If yes, attach a statement indicating the county to which the property was donated and its

value. Attach a certification by the governmental body accepting the property and an officer

of the corporation attesting to the agreed value of the property.)

SCHEDULE II - Production of Heavy Minerals

1.

Enter the total tons produced here and on line 1, column B on front of form.

1.

SCHEDULE III - Production of Other Solid Minerals

1.

List the total tons of each type of solid mineral produced. Use blank space for solid minerals not listed.

Solid Mineral

Tons Produced

Solid Mineral

Tons Produced

Clay

Stone

Gravel

Sand

Lime

Rare Earths

Shells

2.

Enter the combined value at the point of severance of all solid minerals produced.

2. $

3.

Exemptions: Enter the value of solid minerals not subject to tax.

3a. Solid minerals sold to governmental

agencies in this state.

3a. $

3b. Solid minerals upon which the sales tax is eventually

paid to the state under Ch. 212, Florida Statutes.

3b. $

3c. Solid minerals extracted for site improvement under

an approved restoration or reclamation project.

3c.

$

3d. Solid minerals severed solely for direct

application in agricultural uses.

3d. $

Total Exemptions (add lines 3a, 3b, 3c, and 3d)

3. $

4.

Total value subject to tax (subtract line 3 from line 2; enter here and on front of

4. $

form, line 2, column C)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2