Instructions For Resident Credit For Tax Imposed By A Canadian Province - Michigan Department Of Treasury

ADVERTISEMENT

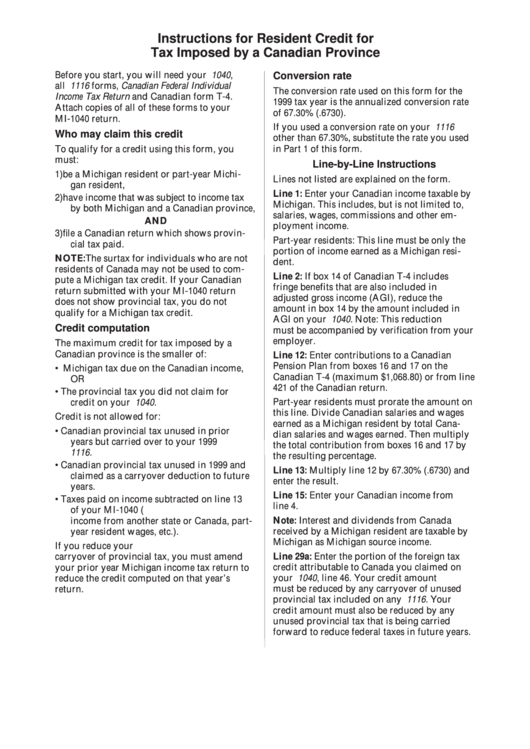

Instructions for Resident Credit for

Tax Imposed by a Canadian Province

Before you start, you will need your U.S. 1040,

Conversion rate

all U.S. 1116 forms, Canadian Federal Individual

The conversion rate used on this form for the

Income Tax Return and Canadian form T-4.

1999 tax year is the annualized conversion rate

Attach copies of all of these forms to your

of 67.30% (.6730).

MI-1040 return.

If you used a conversion rate on your U.S. 1116

Who may claim this credit

other than 67.30%, substitute the rate you used

To qualify for a credit using this form, you

in Part 1 of this form.

must:

Line-by-Line Instructions

1) be a Michigan resident or part-year Michi-

Lines not listed are explained on the form.

gan resident,

Line 1: Enter your Canadian income taxable by

2) have income that was subject to income tax

Michigan. This includes, but is not limited to,

by both Michigan and a Canadian province,

salaries, wages, commissions and other em-

AND

ployment income.

3) file a Canadian return which shows provin-

Part-year residents: This line must be only the

cial tax paid.

portion of income earned as a Michigan resi-

NOTE:The surtax for individuals who are not

dent.

residents of Canada may not be used to com-

Line 2: If box 14 of Canadian T-4 includes

pute a Michigan tax credit. If your Canadian

fringe benefits that are also included in U.S.

return submitted with your MI-1040 return

adjusted gross income (AGI), reduce the

does not show provincial tax, you do not

amount in box 14 by the amount included in

qualify for a Michigan tax credit.

AGI on your U.S. 1040. Note: This reduction

Credit computation

must be accompanied by verification from your

employer.

The maximum credit for tax imposed by a

Canadian province is the smaller of:

Line 12: Enter contributions to a Canadian

Pension Plan from boxes 16 and 17 on the

•

Michigan tax due on the Canadian income,

Canadian T-4 (maximum $1,068.80) or from line

OR

421 of the Canadian return.

• The provincial tax you did not claim for

Part-year residents must prorate the amount on

credit on your U.S. 1040.

this line. Divide Canadian salaries and wages

Credit is not allowed for:

earned as a Michigan resident by total Cana-

• Canadian provincial tax unused in prior

dian salaries and wages earned. Then multiply

years but carried over to your 1999 U.S.

the total contribution from boxes 16 and 17 by

1116.

the resulting percentage.

• Canadian provincial tax unused in 1999 and

Line 13: Multiply line 12 by 67.30% (.6730) and

claimed as a carryover deduction to future

enter the result.

years.

Line 15: Enter your Canadian income from

• Taxes paid on income subtracted on line 13

line 4.

of your MI-1040 (i.e. rental or business

Note: Interest and dividends from Canada

income from another state or Canada, part-

received by a Michigan resident are taxable by

year resident wages, etc.).

Michigan as Michigan source income.

If you reduce your U.S. income tax by a

Line 29a: Enter the portion of the foreign tax

carryover of provincial tax, you must amend

credit attributable to Canada you claimed on

your prior year Michigan income tax return to

your U.S. 1040, line 46. Your credit amount

reduce the credit computed on that year’s

must be reduced by any carryover of unused

return.

provincial tax included on any U.S. 1116. Your

credit amount must also be reduced by any

unused provincial tax that is being carried

forward to reduce federal taxes in future years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1