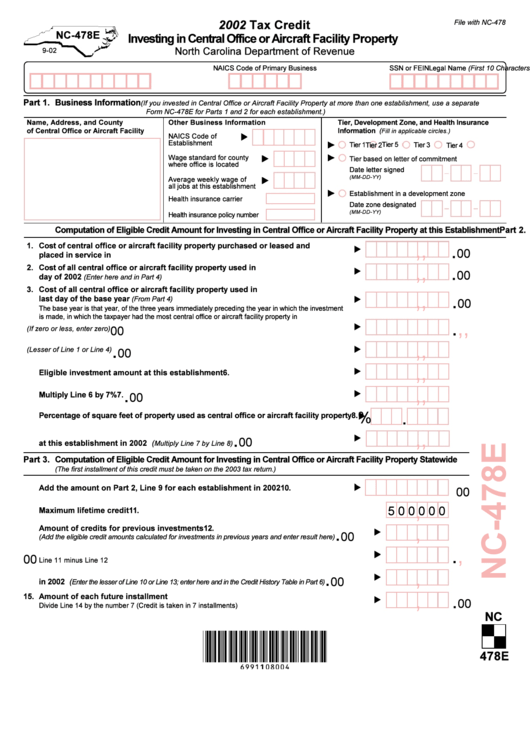

Form Nc-478e - Tax Credit Investing In Central Office Or Aircraft Facility Property - 2002

ADVERTISEMENT

2002 Tax Credit

File with NC-478

NC-478E

Investing in Central Office or Aircraft Facility Property

North Carolina Department of Revenue

(First 10 Characters)

Part 1.

Business Information

(If you invested in Central Office or Aircraft Facility Property at more than one establishment, use a separate

Form NC-478E for Parts 1 and 2 for each establishment.)

Name, Address, and County

Other Business Information

Tier, Development Zone, and Health Insurance

of Central Office or Aircraft Facility

Information (

Fill in applicable circles.)

(MM-DD-YY)

(MM-DD-YY)

Part 2.

Computation of Eligible Credit Amount for Investing in Central Office or Aircraft Facility Property at this Establishment

,

,

.

1.

Cost of central office or aircraft facility property purchased or leased and

00

placed in service in N.C. during 2002

,

,

.

2.

Cost of all central office or aircraft facility property used in N.C. on the last

00

day of 2002

(Enter here and in Part 4)

3.

Cost of all central office or aircraft facility property used in N.C. on the

,

,

.

last day of the base year

(From Part 4)

00

,

,

.

4. Line 2 minus Line 3

00

(If zero or less, enter zero)

,

,

.

5. Eligible investment amount statewide

(Lesser of Line 1 or Line 4)

00

,

,

.

6.

Eligible investment amount at this establishment

00

,

,

.

7.

Multiply Line 6 by 7%

00

.

%

8.

Percentage of square feet of property used as central office or aircraft facility property

,

,

.

9. Eligible Credit Amount for Investing in Central Office or Aircraft Facility Property

00

at this establishment in 2002 (

Multiply Line 7 by Line 8)

Part 3.

Computation of Eligible Credit Amount for Investing in Central Office or Aircraft Facility Property Statewide

(The first installment of this credit must be taken on the 2003 tax return.)

,

,

.

10.

Add the amount on Part 2, Line 9 for each establishment in 2002

00

,

.

5 0 0 0 0 0

11.

Maximum lifetime credit

00

,

.

12.

Amount of credits for previous investments

00

(Add the eligible credit amounts calculated for investments in previous years and enter result here)

,

.

13. Maximum credit for investments in 2002

00

,

.

14. Eligible Credit Amount for Investing in Central Office or Aircraft Facility Property Statewide

00

in 2002 (

Enter the lesser of Line 10 or Line 13; enter here and in the Credit History Table in Part 6)

,

.

15.

Amount of each future installment

00

NC

478E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2