Washington State Unified Registration Statement Addendum - Washington Secretary Of State - 2009

ADVERTISEMENT

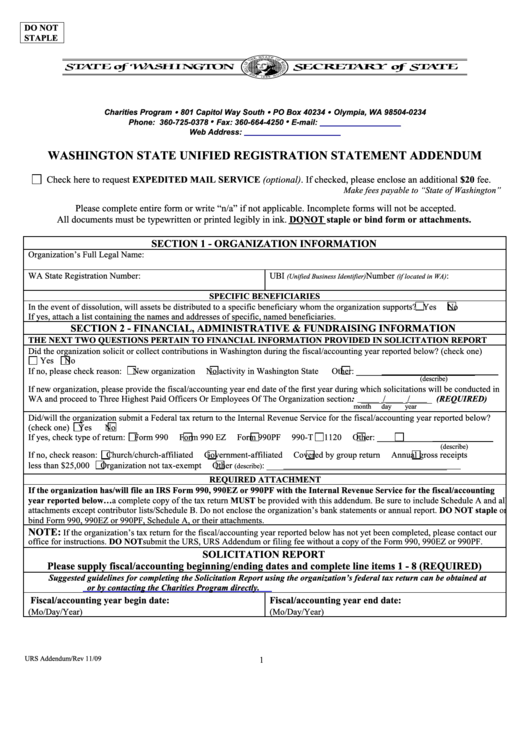

DO NOT

STAPLE

Charities Program • 801 Capitol Way South • PO Box 40234 • Olympia, WA 98504-0234

Phone: 360-725-0378 • Fax: 360-664-4250 • E-mail:

charities@sos.wa.gov

Web Address:

WASHINGTON STATE UNIFIED REGISTRATION STATEMENT ADDENDUM

Check here to request EXPEDITED MAIL SERVICE (optional). If checked, please enclose an additional $20 fee.

Make fees payable to “State of Washington”

Please complete entire form or write “n/a” if not applicable. Incomplete forms will not be accepted.

All documents must be typewritten or printed legibly in ink. DO NOT staple or bind form or attachments.

SECTION 1 - ORGANIZATION INFORMATION

Organization’s Full Legal Name:

WA State Registration Number:

UBI

Number

:

(Unified Business Identifier)

(if located in WA)

SPECIFIC BENEFICIARIES

In the event of dissolution, will assets be distributed to a specific beneficiary whom the organization supports?

Yes

No

If yes, attach a list containing the names and addresses of specific, named beneficiaries.

SECTION 2 - FINANCIAL, ADMINISTRATIVE & FUNDRAISING INFORMATION

THE NEXT TWO QUESTIONS PERTAIN TO FINANCIAL INFORMATION PROVIDED IN SOLICITATION REPORT

Did the organization solicit or collect contributions in Washington during the fiscal/accounting year reported below? (check one)

Yes

No

If no, please check reason:

New organization

No activity in Washington State

Other: ___________________________

(describe)

If new organization, please provide the fiscal/accounting year end date of the first year during which solicitations will be conducted in

WA and proceed to Three Highest Paid Officers Or Employees Of The Organization section: _____/_____/_____ (REQUIRED)

month

day

year

Did/will the organization submit a Federal tax return to the Internal Revenue Service for the fiscal/accounting year reported below?

(check one)

Yes

No

If yes, check type of return:

Form 990

Form 990 EZ

Form 990PF

990-T

1120

Other: ______________

(describe)

If no, check reason:

Church/church-affiliated

Government-affiliated

Covered by group return

Annual gross receipts

less than $25,000

Organization not tax-exempt

Other

: _________________________________________

(describe)

REQUIRED ATTACHMENT

If the organization has/will file an IRS Form 990, 990EZ or 990PF with the Internal Revenue Service for the fiscal/accounting

year reported below…a complete copy of the tax return MUST be provided with this addendum. Be sure to include Schedule A and all

attachments except contributor lists/Schedule B. Do not enclose the organization’s bank statements or annual report. DO NOT staple or

bind Form 990, 990EZ or 990PF, Schedule A, or their attachments.

NOTE:

If the organization’s tax return for the fiscal/accounting year reported below has not yet been completed, please contact our

office for instructions. DO NOT submit the URS, URS Addendum or filing fee without a copy of the Form 990, 990EZ or 990PF.

SOLICITATION REPORT

Please supply fiscal/accounting beginning/ending dates and complete line items 1 - 8 (REQUIRED)

Suggested guidelines for completing the Solicitation Report using the organization’s federal tax return can be obtained at

or by contacting the Charities Program directly.

Fiscal/accounting year begin date:

Fiscal/accounting year end date:

(Mo/Day/Year)

(Mo/Day/Year)

URS Addendum/Rev 11/09

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3