Taxpayer Questionnaire Form

ADVERTISEMENT

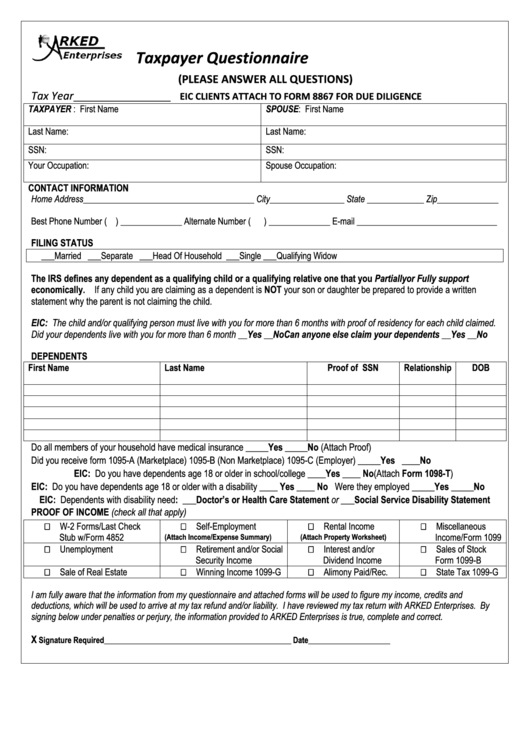

Taxpayer Questionnaire

(PLEASE ANSWER ALL QUESTIONS)

Tax Year

___________________

EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE

TAXPAYER : First Name

SPOUSE: First Name

Last Name:

Last Name:

SSN:

D.O.B.

SSN:

D.O.B.

Your Occupation:

Spouse Occupation:

CONTACT INFORMATION

Home Address_______________________________________ City_________________ State _____________ Zip______________

Best Phone Number (

) ______________ Alternate Number (

) ______________ E-mail ________________________________

FILING STATUS

___Married

___Separate

___Head Of Household

___Single

___Qualifying Widow

The IRS defines any dependent as a qualifying child or a qualifying relative one that you Partially or Fully support

economically. If any child you are claiming as a dependent is NOT your son or daughter be prepared to provide a written

statement why the parent is not claiming the child.

EIC: The child and/or qualifying person must live with you for more than 6 months with proof of residency for each child claimed.

Did your dependents live with you for more than 6 month __Yes __No Can anyone else claim your dependents __Yes __No

DEPENDENTS

First Name

Last Name

Proof of SSN

Relationship

DOB

Do all members of your household have medical insurance _____Yes _____No (Attach Proof)

Did you receive form 1095-A (Marketplace) 1095-B (Non Marketplace) 1095-C (Employer) _____Yes ____No

EIC: Do you have dependents age 18 or older in school/college ____Yes ____ No (Attach Form 1098-T)

EIC: Do you have dependents age 18 or older with a disability ____ Yes ____ No Were they employed _____Yes _____No

EIC: Dependents with disability need: ___Doctor’s or Health Care Statement or ___Social Service Disability Statement

PROOF OF INCOME (check all that apply)

W-2 Forms/Last Check

Self-Employment

Rental Income

Miscellaneous

Stub w/Form 4852

(Attach Income/Expense Summary)

(Attach Property Worksheet)

Income/Form 1099

Unemployment

Retirement and/or Social

Interest and/or

Sales of Stock

Security Income

Dividend Income

Form 1099-B

Sale of Real Estate

Winning Income 1099-G

Alimony Paid/Rec.

State Tax 1099-G

I am fully aware that the information from my questionnaire and attached forms will be used to figure my income, credits and

deductions, which will be used to arrive at my tax refund and/or liability. I have reviewed my tax return with ARKED Enterprises. By

signing below under penalties or perjury, the information provided to ARKED Enterprises is true, complete and correct.

X

Signature Required________________________________________________

Date_____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2