Form Pt-95 - Request For Apportionment Of Ad Valorem Assessment On Vehicles Engaged In Interstate Commerce

ADVERTISEMENT

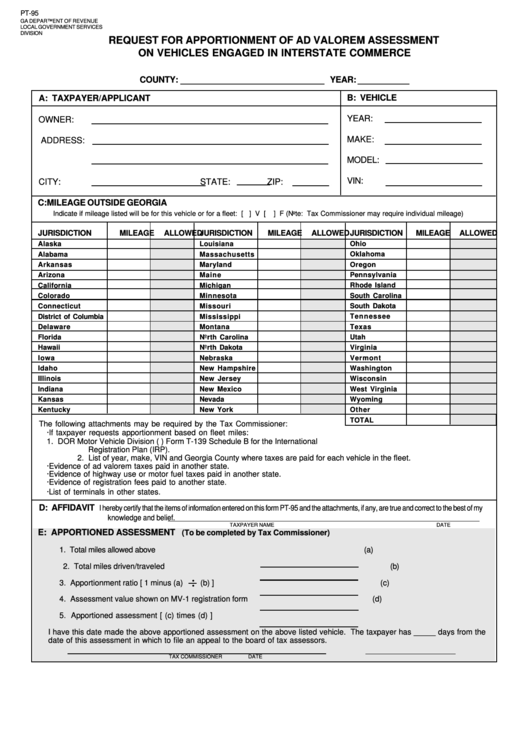

PT-95

GA DEPARTMENT OF REVENUE

LOCAL GOVERNMENT SERVICES

DIVISION

REQUEST FOR APPORTIONMENT OF AD VALOREM ASSESSMENT

ON VEHICLES ENGAGED IN INTERSTATE COMMERCE

____________________________

__________

COUNTY:

YEAR:

B: VEHICLE

A: TAXPAYER/APPLICANT

YEAR:

OWNER:

MAKE:

ADDRESS:

MODEL:

VIN:

CITY:

STATE:

ZIP:

C: MILEAGE OUTSIDE GEORGIA

Indicate if mileage listed will be for this vehicle or for a fleet: [ ] V [

] F (Note: Tax Commissioner may require individual mileage)

JURISDICTION

MILEAGE ALLOWED

JURISDICTION

MILEAGE ALLOWED

JURISDICTION

MILEAGE ALLOWED

Alaska

Louisiana

Ohio

Alabama

Massachusetts

Oklahoma

Arkansas

Maryland

Oregon

Arizona

Maine

Pennsylvania

California

Michigan

Rhode Island

Colorado

Minnesota

South Carolina

Connecticut

Missouri

South Dakota

Tennessee

District of Columbia

Mississippi

Texas

Delaware

Montana

Utah

Florida

North Carolina

Hawaii

North Dakota

Virginia

Iowa

Nebraska

Vermont

Idaho

New Hampshire

Washington

Illinois

New Jersey

Wisconsin

Indiana

New Mexico

West Virginia

Kansas

Nevada

Wyoming

Kentucky

New York

Other

TOTAL

The following attachments may be required by the Tax Commissioner:

·

If taxpayer requests apportionment based on fleet miles:

1. DOR Motor Vehicle Division ( ) Form T-139 Schedule B for the International

Registration Plan (IRP).

2. List of year, make, VIN and Georgia County where taxes are paid for each vehicle in the fleet.

·

Evidence of ad valorem taxes paid in another state.

·

Evidence of highway use or motor fuel taxes paid in another state.

·

Evidence of registration fees paid to another state.

·

List of terminals in other states.

D: AFFIDAVIT

I hereby certify that the items of information entered on this form PT-95 and the attachments, if any, are true and correct to the best of my

knowledge and belief.

TAXPAYER NAME

DATE

E: APPORTIONED ASSESSMENT

(To be completed by Tax Commissioner)

1. Total miles allowed above

(a)

2. Total miles driven/traveled

(b)

. .

3. Apportionment ratio [ 1 minus (a)

(b) ]

(c)

4. Assessment value shown on MV-1 registration form

(d)

5. Apportioned assessment [ (c) times (d) ]

I have this date made the above apportioned assessment on the above listed vehicle. The taxpayer has _____ days from the

date of this assessment in which to file an appeal to the board of tax assessors.

TAX COMMISSIONER

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1