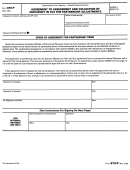

PART II – OFFER OF AGREEMENT FOR AFFECTED ITEMS

Under the provisions of sections 6224(c) and 7121 of the Internal Revenue Code (IRC),

the Commissioner of Internal Revenue and the undersigned taxpayer(s) agree to the

determination of partner level determinations (affected items). These items:

(1) limit the amount of partnership item deductions or credits at the partner level

pursuant to IRC sections 704(d), 465, 469, or any provision of the IRC as set

forth in the attached schedule of adjustments, and/or

(2) are additions to tax, and interest under section 6621(c) of the Internal Revenue

Code, as shown on the attached schedule of adjustments.

The undersigned taxpayer(s), pursuant to the provisions of IRC sections 6224(b) and

6213(d), further agree(s) to waive the restrictions provided by section 6213(a) of the

IRC and consent(s) to the assessment and collection of tax attributable to the

application of IRC sections 704(d), 465, 469, or any provisions of the IRC as set forth in

the schedule of adjustments, and any additions to tax, and interest under IRC section

6621(c), as set forth in the attached schedule of adjustments; plus any interest provided

by law.

This agreement is conditional, and will not become effective or final until this agreement

form is returned to Internal Revenue and is signed by the Commissioner’s representative.

The one year extension of the period of limitations on assessment under IRC section

6229(f) will not begin to run until the date the Commissioner’s representative signs this

form for the Commissioner. If this is a partial agreement, the period of limitations for

assessing any tax attributable to the settled items shall be determined as if this agreement

had not been entered into.

If this agreement form is signed for the Commissioner, the treatment of the specified

affected items under this agreement will not be reopened in the absence of fraud,

malfeasance, or misrepresentation of fact; and no claim for an adjustment to these

affected items or for a refund or credit based on any change in the treatment of these

affected items may be filed or prosecuted.

Signature of Taxpayer

Date Signed

Phone Number

Date Signed

Phone Number

Signature of Taxpayer

By (Signature and Title)

Date Signed

Phone Number

Date accepted for Commissioner

Signature

FOR

INTERNAL

REVENUE

Office

Title

USE ONLY

870-L

(See Instructions for Signing Agreement)

Catalog Number 10428C

Form

(Rev. 5-2006)

1

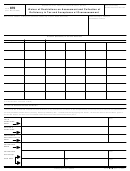

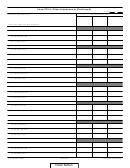

1 2

2 3

3 4

4