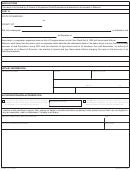

INSTRUCTIONS

This return is to be filed by all Farmer’s Cooperative Credit Associations authorized to do business in Missouri.

PART III

STATE OF MISSOURI

ss

COUNTY OF

We, the undersigned

, as President, and

, as Secretary of

Association, a corporation organized under an Act of Congress known as the Farm Credit Act of 1933 with its principal office at

,

Missouri, each being first duly sworn upon our separate oaths state that the statements made in the above return are true; that the principal

business of said Association during 2007 was the extension of agricultural credit to its members; that said Association, by authority of

a resolution of its Board of Directors, has elected to absorb and pay these taxes without charging the same to the accounts of its

individual members.

PRESIDENT

SECRETARY

NOTARY INFORMATION

AFFIX SEAL IN THIS BOX

STATE OF

COUNTY OR CITY OF

SWORN TO AND SUBSCRIBED BEFORE ME THIS

DAY OF

, 20

MY COMMISSION EXPIRES

NOTARY PUBLIC

__ __ / __ __ / __ __ __ __

AUTHORIZATION/NON-AUTHORIZATION

I authorize the Director of Revenue or his/her

I do NOT authorize the Director of Revenue or his/

PREPARER’S TELEPHONE

delegate to discuss my return and attachments with

her delegate to discuss my return and attachments

(__ __ __) __ __ __ - __ __ __ __

the preparer or any member of his/her firm.

with the preparer or any member of his/her firm.

I declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for

any tax exemption, credit or abatement if I employ such aliens.

PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

DATE

__ __ / __ __ / __ __ __ __

PREPARER’S ADDRESS AND ZIP CODE

FEIN OR PTIN

MO 860-1141 (11-2007)

DOR-INT-5 (11-2007)

1

1 2

2