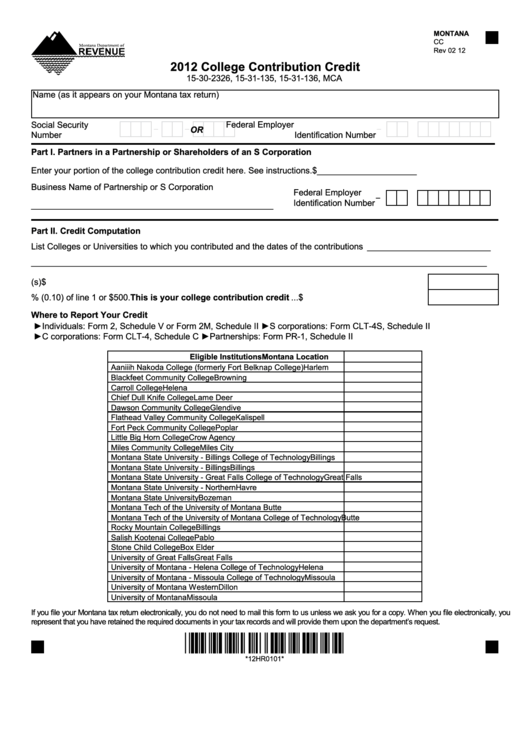

Montana Form Cc - College Contribution Credit - 2012

ADVERTISEMENT

1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

MONTANA

4

4

CC

5

5

Rev 02 12

6

6

2012 College Contribution Credit

7

7

8

15-30-2326, 15-31-135, 15-31-136, MCA

8

9

9

Name (as it appears on your Montana tax return)

10

10

11

11

12

12

Social Security

Federal Employer

-

-

-

13

OR

13

Number

Identification Number

14

14

15

15

Part I. Partners in a Partnership or Shareholders of an S Corporation

16

16

Enter your portion of the college contribution credit here. See instructions.

$_____________________

17

17

18

18

Business Name of Partnership or S Corporation

19

Federal Employer

19

-

20

Identification Number

20

___________________________________________________

21

21

22

22

Part II. Credit Computation

23

23

24

24

List Colleges or Universities to which you contributed and the dates of the contributions __________________________

25

25

________________________________________________________________________________________________

26

26

27

27

1. Enter total amount of contribution(s) ................................................................................................. $

28

28

29

29

2. Enter here the lesser of 10% (0.10) of line 1 or $500. This is your college contribution credit ... $

30

30

Where to Report Your Credit

31

31

►Individuals: Form 2, Schedule V or Form 2M, Schedule II

►S corporations: Form CLT-4S, Schedule II

32

32

►C corporations: Form CLT-4, Schedule C

►Partnerships: Form PR-1, Schedule II

33

33

34

34

Eligible Institutions

Montana Location

35

35

Aaniiih Nakoda College (formerly Fort Belknap College)

Harlem

36

36

Blackfeet Community College

Browning

37

37

Carroll College

Helena

38

38

Chief Dull Knife College

Lame Deer

39

39

Dawson Community College

Glendive

40

40

Flathead Valley Community College

Kalispell

41

41

Fort Peck Community College

Poplar

42

42

Little Big Horn College

Crow Agency

43

43

Miles Community College

Miles City

44

44

Montana State University - Billings College of Technology

Billings

45

45

Montana State University - Billings

Billings

46

46

Montana State University - Great Falls College of Technology

Great Falls

47

47

Montana State University - Northern

Havre

48

48

Montana State University

Bozeman

49

49

Montana Tech of the University of Montana

Butte

50

50

Montana Tech of the University of Montana College of Technology

Butte

51

51

Rocky Mountain College

Billings

52

52

Salish Kootenai College

Pablo

53

53

Stone Child College

Box Elder

54

54

University of Great Falls

Great Falls

55

55

University of Montana - Helena College of Technology

Helena

56

56

University of Montana - Missoula College of Technology

Missoula

57

57

University of Montana Western

Dillon

58

58

University of Montana

Missoula

59

59

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

60

60

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

61

61

62

*12HR0101*

62

63

63

64

64

*12HR0101*

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

8485

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2