City Of Chandler Sales & Use Tax Return

ADVERTISEMENT

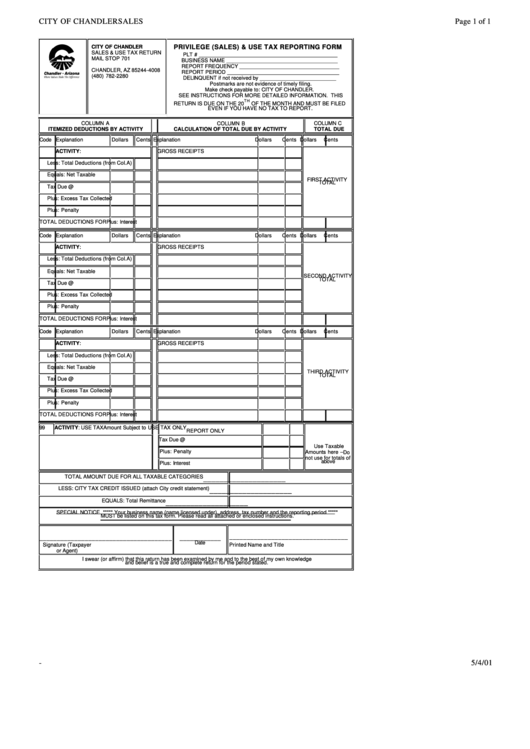

CITY OF CHANDLERSALES

Page 1 of 1

CITY OF CHANDLER

PRIVILEGE (SALES) & USE TAX REPORTING FORM

SALES & USE TAX RETURN

PLT # _______________________________________________

MAIL STOP 701

BUSINESS NAME ______________________________________

P.O. BOX 4008

REPORT FREQUENCY __________________________________

CHANDLER, AZ 85244-4008

REPORT PERIOD ______________________________________

(480) 782-2280

DELINQUENT if not received by __________________________

Postmarks are not evidence of timely filing.

Make check payable to: CITY OF CHANDLER.

SEE INSTRUCTIONS FOR MORE DETAILED INFORMATION. THIS

TH

RETURN IS DUE ON THE 20

OF THE MONTH AND MUST BE FILED

EVEN IF YOU HAVE NO TAX TO REPORT.

COLUMN A

COLUMN B

COLUMN C

ITEMIZED DEDUCTIONS BY ACTIVITY

CALCULATION OF TOTAL DUE BY ACTIVITY

TOTAL DUE

Code Explanation

Dollars

Cents

Explanation

Dollars

Cents Dollars

Cents

ACTIVITY :

GROSS RECEIPTS

Less: Total Deductions (from Col.A)

Equals: Net Taxable

FIRST ACTIVITY

TOTAL

Tax Due @

Plus: Excess Tax Collected

Plus: Penalty

TOTAL DEDUCTIONS FOR

Plus: Interest

Code Explanation

Dollars

Cents

Explanation

Dollars

Cents Dollars

Cents

ACTIVITY :

GROSS RECEIPTS

Less: Total Deductions (from Col.A)

Equals: Net Taxable

SECOND ACTIVITY

TOTAL

Tax Due @

Plus: Excess Tax Collected

Plus: Penalty

TOTAL DEDUCTIONS FOR

Plus: Interest

Code Explanation

Dollars

Cents

Explanation

Dollars

Cents Dollars

Cents

ACTIVITY :

GROSS RECEIPTS

Less: Total Deductions (from Col.A)

Equals: Net Taxable

THIRD ACTIVITY

TOTAL

Tax Due @

Plus: Excess Tax Collected

Plus: Penalty

TOTAL DEDUCTIONS FOR

Plus: Interest

99

ACTIVITY : USE TAX

Amount Subject to USE TAX ONLY

REPORT ONLY

Tax Due @

Use Taxable

Plus: Penalty

Amounts here – Do

not use for totals of

Plus: Interest

above

TOTAL AMOUNT DUE FOR ALL TAXABLE CATEGORIES

____________________

LESS: CITY TAX CREDIT ISSUED (attach City credit statement)

____________________

EQUALS: Total Remittance

____________________

SPECIAL NOTICE ***** Your business name (name licensed under), address, tax number and the reporting period *****

MUST be listed on this tax form. Please read all attached or enclosed instructions.

______________________________________

____________

__________________________________

Signature (Taxpayer

Date

Printed Name and Title

or Agent)

I swear (or affirm) that this return has been examined by me and to the best of my own knowledge

and belief is a true and complete return for the period stated.

5/4/01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1