Form 4220 - Michigan Individual Income Tax Barcode Datasheet - 2008

ADVERTISEMENT

Michigan Department of Treasury

4220 (Rev. 9-08), Page 1

2008 MICHIGAN Individual

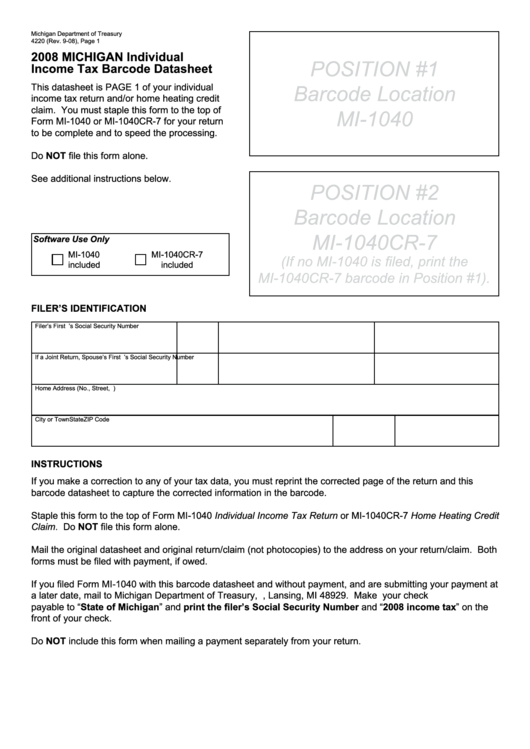

POSITION #1

Income Tax Barcode Datasheet

Barcode Location

This datasheet is PAGE 1 of your individual

income tax return and/or home heating credit

claim. You must staple this form to the top of

MI-1040

Form MI-1040 or MI-1040CR-7 for your return

to be complete and to speed the processing.

Do NOT file this form alone.

See additional instructions below.

POSITION #2

Barcode Location

MI-1040CR-7

Software Use Only

MI-1040

MI-1040CR-7

(If no MI-1040 is filed, print the

included

included

MI-1040CR-7 barcode in Position #1).

FILER’S IDENTIFICATION

Filer’s First Name

M.I.

Last Name

Filer’s Social Security Number

If a Joint Return, Spouse’s First Name

M.I.

Last Name

Spouse’s Social Security Number

Home Address (No., Street, P.O. Box or Rural Route)

City or Town

State

ZIP Code

INSTRUCTIONS

If you make a correction to any of your tax data, you must reprint the corrected page of the return and this

barcode datasheet to capture the corrected information in the barcode.

Staple this form to the top of Form MI-1040 Individual Income Tax Return or MI-1040CR-7 Home Heating Credit

Claim. Do NOT file this form alone.

Mail the original datasheet and original return/claim (not photocopies) to the address on your return/claim. Both

forms must be filed with payment, if owed.

If you filed Form MI-1040 with this barcode datasheet and without payment, and are submitting your payment at

a later date, mail to Michigan Department of Treasury, P.O. Box 30727, Lansing, MI 48929. Make your check

payable to “State of Michigan” and print the filer’s Social Security Number and “2008 income tax” on the

front of your check.

Do NOT include this form when mailing a payment separately from your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1