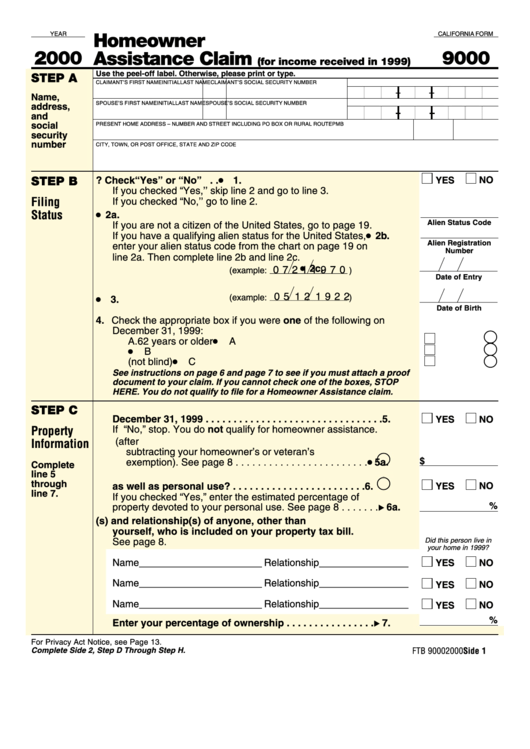

California Form Ftb 9000 - Homeowner Assistance Claim - 2000

ADVERTISEMENT

YEAR

CALIFORNIA FORM

Homeowner

2000

Assistance Claim

9000

(for income received in 1999)

Use the peel-off label. Otherwise, please print or type.

STEP A

CLAIMANT’S FIRST NAME

INITIAL LAST NAME

CLAIMANT’S SOCIAL SECURITY NUMBER

Name,

SPOUSE’S FIRST NAME

INITIAL LAST NAME

SPOUSE’S SOCIAL SECURITY NUMBER

address,

and

social

PRESENT HOME ADDRESS – NUMBER AND STREET INCLUDING PO BOX OR RURAL ROUTE

PMB NO.

APT. NO.

security

number

CITY, TOWN, OR POST OFFICE, STATE AND ZIP CODE

•

1. Are you a United States citizen? Check “Yes” or “No” . .

1.

NO

STEP B

YES

If you checked “Yes,’’ skip line 2 and go to line 3.

Filing

If you checked “No,’’ go to line 2.

Status

•

2. Benefit Eligibility for Noncitizens

2a.

Alien Status Code

If you are not a citizen of the United States, go to page 19.

•

If you have a qualifying alien status for the United States,

2b.

Alien Registration

enter your alien status code from the chart on page 19 on

Number

line 2a. Then complete line 2b and line 2c.

•

2c.

0 7 2 1 1 9 7 0

(example:

)

Date of Entry

0 5 1 2 1 9 2 2

(example:

)

•

3. Enter your date of birth . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Date of Birth

4. Check the appropriate box if you were one of the following on

December 31, 1999:

•

A.

62 years or older

A

•

B.

Under 62 and blind

B

•

C.

Under 62 and disabled (not blind)

C

See instructions on page 6 and page 7 to see if you must attach a proof

document to your claim. If you cannot check one of the boxes, STOP

HERE. You do not qualify to file for a Homeowner Assistance claim.

5. Did you own and live in your home on

STEP C

December 31, 1999 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

YES

NO

If “No,” stop. You do not qualify for homeowner assistance.

Property

a. Enter the FULL value of your property (after

Information

subtracting your homeowner’s or veteran’s

•

$

exemption). See page 8 . . . . . . . . . . . . . . . . . . . . . . . .

5a.

Complete

line 5

6. Is your property used for rental and/or business

through

NO

as well as personal use? . . . . . . . . . . . . . . . . . . . . . . . .

6.

YES

line 7.

If you checked “Yes,” enter the estimated percentage of

%

property devoted to your personal use. See page 8 . . . . . . .

6a.

7. List name(s) and relationship(s) of anyone, other than

yourself, who is included on your property tax bill.

Did this person live in

See page 8.

your home in 1999?

Name______________________ Relationship________________

YES

NO

Name______________________ Relationship________________

YES

NO

Name______________________ Relationship________________

NO

YES

%

Enter your percentage of ownership . . . . . . . . . . . . . . . .

7.

For Privacy Act Notice, see Page 13.

Complete Side 2, Step D Through Step H.

FTB 9000 2000 Side 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2