Form Mo-Ptc - Property Tax Credit Claim/ Pharmaceutical Tax Credit - 2000 Page 2

ADVERTISEMENT

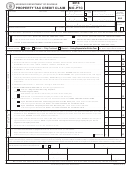

2000 FORM MO-PTC

PAGE 2

SECTION B: Did you file a Form MO-1040 or have income from sources not included on Page 1,

Section A? If so, complete Section B. Complete this section ONLY if you have income not

listed on Page 1, Section A. If you do have other income, complete this section and enter

total from Line F, on Page 1, Section A, Line 4.

If filing Form MO-1040, you must enclose Form MO-1040 with this form. If you are MARRIED —

FILING COMBINED, BOTH incomes must be entered.

Enclose

A. Did you file a Form MO-1040, Individual Income Tax Return? If so, enter income from Form

00

Form

MO-1040, Line 6 and skip to Line C . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

A

MO-1040

B. If you do not file a Form MO-1040, enter wages,

Enclose

00

Form W-2(s)

salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B

Enclose

Form

00

C. Did you receive railroad retirement benefits? If so, enter amount before any deductions. . . . . . . . . . .

C

RRB-1099

D. Did you receive any veteran’s payments or benefits? If so, enter amount before any

00

deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

D

E. Did you have any nonbusiness loss(es)? (If so, you must include nonbusiness losses in your

Enclose

Form

00

household income here.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E

MO-1040

F. TOTAL — Section B — add Lines A through E. Enter total here

00

and on Section A, Line 4 (front of form) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F

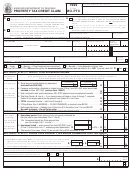

SECTION C: Complete this section only if you rented your home.

(Complete additional Form MO-CRP(s) if you occupied more than one rental unit.)

1. ARE YOU RELATED TO YOUR LANDLORD?

YES

NO

IF YES, HOW?

2. LANDLORD’S NAME AND SOCIAL SECURITY NUMBER

3. LANDLORD’S HOME ADDRESS AND CITY, STATE AND ZIP CODE

4. RENTAL PERIOD

FROM:

MONTH

DAY

YEAR

TO:

MONTH

DAY

YEAR

—

—

2000

—

—

2000

DURING YEAR

00

5. Enter your gross rent paid. (Enclose rental receipt(s).) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6. You may need to reduce your rent paid. Check the box and enter the appropriate percentage on

Line 6.

A. APARTMENT, HOUSE, MOBILE HOME, MOBILE HOME LOT, DUPLEX OR

LOW INCOME HOUSING — 100%

B. BOARDING HOME — 50%

C. RESIDENTIAL CARE — 50%

D. SKILLED OR INTERMEDIATE CARE NURSING HOME — 45%

E. HOTEL If meals are included, enter — 50%; Otherwise, enter — 100%

F. SHARED HOME—If you shared your home with relatives and/or friends (other than your spouse,

if filing combined), enter the appropriate percentage of your home occupied. ________________

%

You must enclose copies of your rent receipts or copies of cancelled checks for rent paid. . . . . . . 6

7. Net rent paid. Multiply Line 5 by the percent on Line 6. ENTER HERE AND

00

ON FORM MO-PTC, LINE 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

MO 860-1089 (11-2000)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2