Form Sls 450 - Revised State And Local Sales And Use Tax Return

ADVERTISEMENT

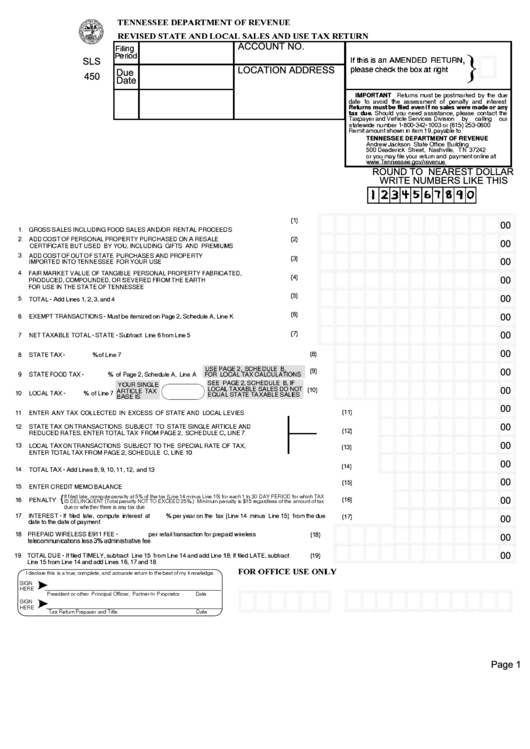

TENNESSEE DEPARTMENT OF REVENUE

REVISED STATE AND LOCAL SALES AND USE TAX RETURN

Filing

ACCOUNT NO.

Period

MN

If this is an AMENDED RETURN,

SLS

please check the box at right

LOCATION ADDRESS

Due

450

Date

IMPORTANT

Returns must be postmarked by the due

:

date to avoid the assessment of penalty and interest.

Returns must be filed even if no sales were made or any

tax due.

Should you need assistance, please contact the

Taxpayer and Vehicle Services Division by calling our

statewide number 1-800-342-1003 or (615) 253-0600.

Remit amount shown in item 19, payable to:

TENNESSEE DEPARTMENT OF REVENUE

Andrew Jackson State Office Building

500 Deaderick Street, Nashville, TN 37242

or you may file your return and payment online at

ROUND TO NEAREST DOLLAR

WRITE NUMBERS LIKE THIS

MMMMMMMMMMMMMN

(1)

00

1. GROSS SALES INCLUDING FOOD SALES AND/OR RENTAL PROCEEDS

HHHHHHHHHHHHHI

2. ADD COST OF PERSONAL PROPERTY PURCHASED ON A RESALE

(2)

CERTIFICATE BUT USED BY YOU, INCLUDING GIFTS AND PREMIUMS .

00

HHHHHHHHHHHHHI

3. ADD COST OF OUT OF STATE PURCHASES AND PROPERTY

(3)

IMPORTED INTO TENNESSEE FOR YOUR USE

............................

00

HHHHHHHHHHHHHI

4. FAIR MARKET VALUE OF TANGIBLE PERSONAL PROPERTY FABRICATED,

(4)

PRODUCED, COMPOUNDED, OR SEVERED FROM THE EARTH

00

FOR USE IN THE STATE OF TENNESSEE

HHHHHHHHHHHHHI

(5)

5. TOTAL - Add Lines 1, 2, 3, and 4

.............................................

00

HHHHHHHHHHHHHI

(6)

6. EXEMPT TRANSACTIONS - Must be itemized on Page 2, Schedule A, Line K

00

HHHHHHHHHHHHHI

(7)

7. NET TAXABLE TOTAL - STATE - Subtract Line 6 from Line 5

..................

00

HHHHHHHHHHHHI

(8)

8. STATE TAX -

% of Line 7

00

.................................................

HHHHHHHHHHHHI

USE PAGE 2, SCHEDULE B,

(9)

00

9.

STATE FOOD TAX -

% of Page 2, Schedule A, Line A

FOR LOCAL TAX CALCULATIONS

HHHHHHHHHHHHI

SEE PAGE 2, SCHEDULE B, IF

YOUR SINGLE

LOCAL TAXABLE SALES DO NOT (10)

ARTICLE TAX

00

10. LOCAL TAX -

% of Line 7

EQUAL STATE TAXABLE SALES

BASE IS

HHHHHHHHHI

00

(11)

11.

ENTER ANY TAX COLLECTED IN EXCESS OF STATE AND LOCAL LEVIES

HHHHHHHHHI

12. STATE TAX ON TRANSACTIONS SUBJECT TO STATE SINGLE ARTICLE AND

00

(12)

REDUCED RATES, ENTER TOTAL TAX FROM PAGE 2, SCHEDULE C, LINE 7.

HHHHHHHHHI

13. LOCAL TAX ON TRANSACTIONS SUBJECT TO THE SPECIAL RATE OF TAX,

(13)

00

ENTER TOTAL TAX FROM PAGE 2, SCHEDULE C, LINE 10.

HHHHHHHHHI

00

(14)

14. TOTAL TAX - Add Lines 8, 9, 10, 11, 12, and 13

HHHHHHHHI

(15)

00

15. ENTER CREDIT MEMO BALANCE

.......................................................

HHHHHHHHI

If filed late, compute penalty at 5% of the tax (Line 14 minus Line 15) for each 1 to 30 DAY PERIOD for which TAX

(16)

16. PENALTY:

{

IS DELINQUENT (Total penalty NOT TO EXCEED 25%.) Minimum penalty is $15 regardless of the amount of tax

00

due or whether there is any tax due

HHHHHHHHI

17.

INTEREST - If filed late, compute interest at

% per year on the tax (Line 14 minus Line 15) from the due

(17)

00

date to the date of payment

.............................................................

MMMM HHHHHHHHI

18. PREPAID WIRELESS E911 FEE -

per retail transaction for prepaid wireless

(18)

00

telecommunications less 3% administrative fee

HHHHHHHHHHHHI

19.

TOTAL DUE - If filed TIMELY, subtract Line 15 from Line 14 and add Line 18; If filed LATE, subtract

(19)

00

Line 15 from Line 14 and add Lines 16, 17 and 18.

FOR OFFICE USE ONLY

I declare this is a true, complete, and accurate return to the best of my knowledge.

SIGN

MMMMMMMMMMMN

HERE

MMMMMMN

President or other Principal Officer, Partner or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2