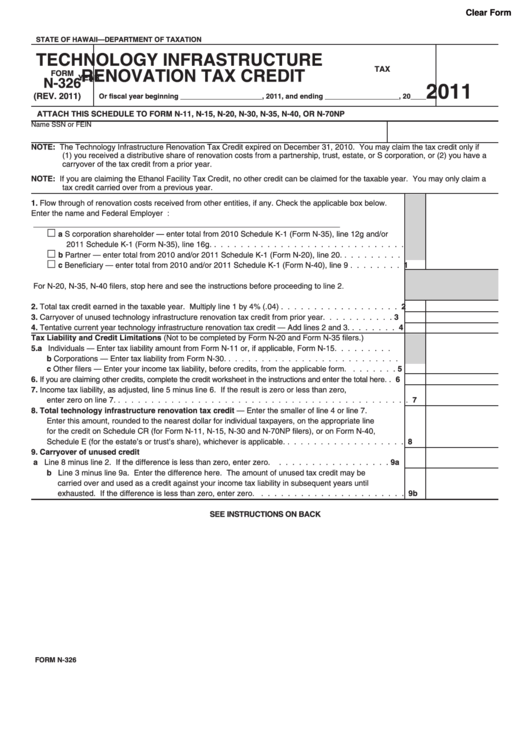

Clear Form

STATE OF HAWAII—DEPARTMENT OF TAXATION

TECHNOLOGY INFRASTRUCTURE

TAX

RENOVATION TAX CREDIT

FORM

YEAR

N-326

2011

(REV. 2011)

Or fiscal year beginning _____________________, 2011, and ending ___________________, 20____

ATTACH THIS SCHEDULE TO FORM N-11, N-15, N-20, N-30, N-35, N-40, OR N-70NP

Name

SSN or FEIN

NOTE: The Technology Infrastructure Renovation Tax Credit expired on December 31, 2010. You may claim the tax credit only if

(1) you received a distributive share of renovation costs from a partnership, trust, estate, or S corporation, or (2) you have a

carryover of the tax credit from a prior year.

NOTE: If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the taxable year. You may only claim a

tax credit carried over from a previous year.

1.

Flow through of renovation costs received from other entities, if any. Check the applicable box below.

Enter the name and Federal Employer I.D. No. of Entity:

______________________________________________________________________

a S corporation shareholder — enter total from 2010 Schedule K-1 (Form N-35), line 12g and/or

2011 Schedule K-1 (Form N-35), line 16g. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Partner — enter total from 2010 and/or 2011 Schedule K-1 (Form N-20), line 20. . . . . . . . . .

c Beneficiary — enter total from 2010 and/or 2011 Schedule K-1 (Form N-40), line 9 . . . . . . . .

1

For N-20, N-35, N-40 filers, stop here and see the instructions before proceeding to line 2.

2.

2

Total tax credit earned in the taxable year. Multiply line 1 by 4% (.04) . . . . . . . . . . . . . . . . . .

3.

3

Carryover of unused technology infrastructure renovation tax credit from prior year. . . . . . . . . . .

4.

4

Tentative current year technology infrastructure renovation tax credit — Add lines 2 and 3. . . . . . . .

Tax Liability and Credit Limitations (Not to be completed by Form N-20 and Form N-35 filers.)

5.

a Individuals — Enter tax liability amount from Form N-11 or, if applicable, Form N-15. . . . . . . . .

b Corporations — Enter tax liability from Form N-30. . . . . . . . . . . . . . . . . . . . . . . . . . .

c Other filers — Enter your income tax liability, before credits, from the applicable form. . . . . . . .

5

6.

6

If you are claiming other credits, complete the credit worksheet in the instructions and enter the total here. .

7.

Income tax liability, as adjusted, line 5 minus line 6. If the result is zero or less than zero,

7

enter zero on line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Total technology infrastructure renovation tax credit — Enter the smaller of line 4 or line 7.

Enter this amount, rounded to the nearest dollar for individual taxpayers, on the appropriate line

for the credit on Schedule CR (for Form N-11, N-15, N-30 and N-70NP filers), or on Form N-40,

8

Schedule E (for the estate’s or trust’s share), whichever is applicable. . . . . . . . . . . . . . . . . . .

9.

Carryover of unused credit

a Line 8 minus line 2. If the difference is less than zero, enter zero.

9a

. . . . . . . . . . . . . . . . .

b Line 3 minus line 9a. Enter the difference here. The amount of unused tax credit may be

carried over and used as a credit against your income tax liability in subsequent years until

9b

exhausted. If the difference is less than zero, enter zero. . . . . . . . . . . . . . . . . . . . . . .

SEE INSTRUCTIONS ON BACK

FORM N-326

1

1