Reports Of Property Value Instructions - Texas Comptroller Of Public Accounts Page 27

ADVERTISEMENT

Item 26. Capped value of residence homesteads. Tax

special procedures should be reported at the special

value. No loss should be reported for properties ap-

Code Section 23.23 provides that the chief appraiser shall

retain both the market value and the appraised capped

praised by special procedures. (Do not include any

value of homesteads subject to the 10 percent per year

value reported in Item 2 on Page 1.)

cap. If it has been three years since the last reappraisal, the

Total. (Bottom of column II) Report the sum of the

percentage would be 30 percent maximum increase since

total category values. This value should be the same as

the last reappraisal value. This item should equal Line 25

the value reported in Item 4, Page 1.

minus Line 15. Report only the value of capped residential

homesteads after application of the cap.

Uncertified Value. Report all uncertified market value

in the appropriate category before application of the

Example:

cap is applied. Do not include totally exempt property.

Last reappraisal—two years ago:

Item 29. Top ten taxpayers. Please list the top ten tax-

Previous Appraised Value

$ 100,000

payers in your district in descending order, based on to-

Current Year Market Value

$ 130,000

tal taxable value. Although the report requests appraised

Capped Value at 10 percent

and taxable values for each taxpayer, inclusion on the list

is based on the taxpayer’s total taxable value rather than

per year for two years

$ 120,000

total appraised value.

Value lost to 10 percent cap

$ 10,000

Please describe any factors that might affect the value of

For the current year the appraised value (capped value)

properties in your city. Please use the space provided or

can only be $120,000 because of the 10 percent cap. The

additional sheets, if necessary. Examples are land located

market value for this property would still be $130,000.

in the flood plain, loss of businesses from the tax roll, de-

Item 27. Total levy loss due to the over-65/disabled ceil-

pleting oil and gas resources, irregular size and shape of

ing. Please report the levy lost to the tax ceiling on home-

vacant lots and loss in value caused by flood and drought.

steads for the elderly/disabled, as provided in Tax Code

Please sign and date this report, and write your title and

Section 11.261. The amount is not the “frozen” taxes paid

office phone number in the appropriate spaces.

but the difference between what would have been paid and

what was actually paid.

Return the original and one copy of each document re-

quested by the due date to the address shown on Page 2.

Item 28. List the total value shown on the tax roll for

each category (Page 4):

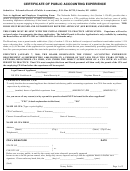

2007 City Report of Property Value—Short Form

Column (I): Number of Items. List the number of

Please follow the instructions on the back of the form.

items requested in each category. For several catego-

ries, we request the number of properties or the num-

Cities with population of less than 2,500

ber of accounts. For other categories, we request the

Cities that have a population of less than 2,500 are not

number of vacant lots (C), parcels (E), companies (J)

required to fill out the City Report of Property Value—

and leases (G1).

Long Form. They should, however, send in some kind of

correspondence stating the taxable value for the city, the

Column (II): Total Value. This value should reflect

Maintenance and Operation rate (M&O), the Interest

the market value of the land, the improvement and the

and Sinking rate (I&S), the total tax rate, the actual levy

taxable personal property for the identified taxing unit

and the city’s local percentage homestead exemptions.

before the 10 percent cap is applied. Do not include

You may send the information to the address listed on

property that is receiving a total exemption. Some ex-

Page 2 or fax the information to the Reporting Section at

amples are foreign trade zones, low-income housing,

(512) 305-9801 or (512) 463-2427.

religious organizations, etc. Properties appraised by

24

Reports of Property Value Instructions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28