Form Sw1 - Employer'S Monthly Return Of Tax Withheld - City Of Sylvania, Ohio Division Of Taxation

ADVERTISEMENT

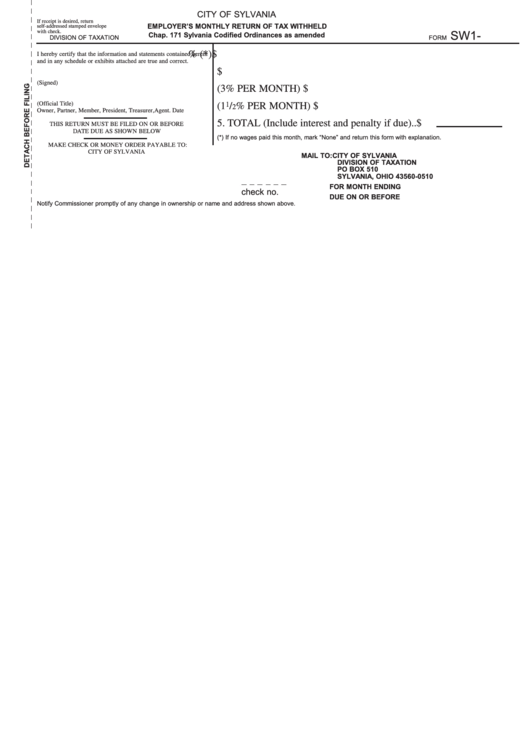

CITY OF SYLVANIA

If receipt is desired, return

EMPLOYER’S MONTHLY RETURN OF TAX WITHHELD

self-addressed stamped envelope

SW1-

with check.

Chap. 171 Sylvania Codified Ordinances as amended

DIVISION OF TAXATION

FORM

1. Actual Tax Withheld in month at 1 1/2% (*)

$ ..........................

I hereby certify that the information and statements contained herein

and in any schedule or exhibits attached are true and correct.

2. Adjustment of Tax for prior month ................ $ ..........................

(Signed) ............................................................................................

3. Penalty (3% PER MONTH) .......................... $ ..........................

(Official Title)....................................................................................

1

4. Interest (1

/

% PER MONTH) ...................... $ ..........................

2

Owner, Partner, Member, President, Treasurer, Agent. Date

5. TOTAL (Include interest and penalty if due) .. $

THIS RETURN MUST BE FILED ON OR BEFORE

DATE DUE AS SHOWN BELOW

(*) If no wages paid this month, mark “None” and return this form with explanation.

MAKE CHECK OR MONEY ORDER PAYABLE TO:

CITY OF SYLVANIA

MAIL TO: CITY OF SYLVANIA

DIVISION OF TAXATION

PO BOX 510

SYLVANIA, OHIO 43560-0510

FOR MONTH ENDING

check no.

DUE ON OR BEFORE

Notify Commissioner promptly of any change in ownership or name and address shown above.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2