Computation Of Springdale Taxable Income - City Of Springdale, Ohio

ADVERTISEMENT

*

*

L

TACG

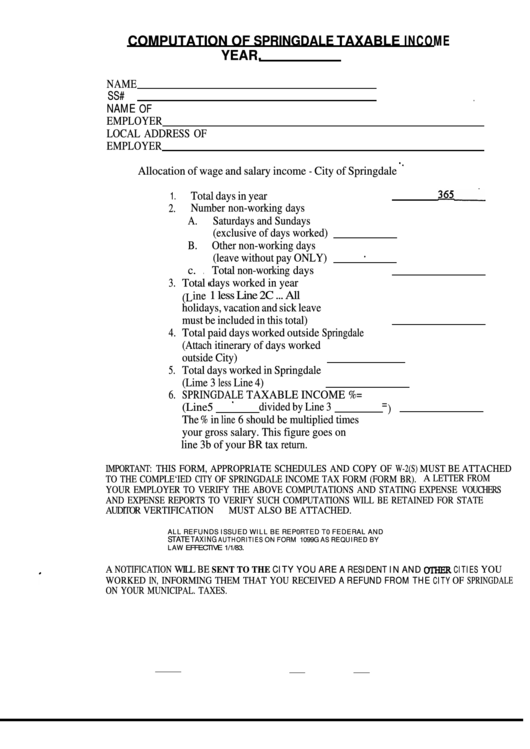

COMPUTATION OF SPRINGDALE TAXABLE INCOME

YEAR.

NAME

.

SS#

NAME

OF

EMPLOYER

LOCAL ADDRESS OF

EMPLOYER

Allocation of wage and salary income - City of Springdale

Total days in year

1.

2.

Number non-working days

A.

Saturdays and Sundays

(exclusive of days worked)

B.

Other non-working days

(leave without pay ONLY)

c.

Total non-working days

l

3.

Total

days worked in year

1 less Line 2C ... All

(L ine

holidays, vacation and sick leave

must be included in this total)

4.

Total paid days worked outside Springdale

(Attach itinerary of days worked

outside City)

5. Total days worked in Springdale

(Lime 3 less Line 4)

6. SPRINGDALE TAXABLE INCOME %=

= )

divided by Line 3

(Line5

The % in line 6 should be multiplied times

your gross salary. This figure goes on

line 3b of your BR tax return.

IMPORTANT: THIS FORM, APPROPRIATE SCHEDULES AND COPY OF W-2(S) MUST BE ATTACHED

TO THE COMPLE‘IED CITY OF SPRINGDALE INCOME TAX FORM (FORM BR). A LETTER FROM

YOUR EMPLOYER TO VERIFY THE ABOVE COMPUTATIONS AND STATING EXPENSE VOUCHERS

AND EXPENSE REPORTS TO VERIFY SUCH COMPUTATIONS WILL BE RETAINED FOR STATE

AUDITOR VERTIFICATION MUST ALSO BE ATTACHED.

ALL REFUNDS ISSUED WILL BE REP0RTED T0 FEDERAL AND

STATE TAXING

AUTHORITIES ON FORM 1099G AS REQUIRED BY

LAW E F F E C T I V E 1/1/83.

SENT TO THE CITY YOU ARE A RESIDENT IN AND m CITIES

A NOTIFICATION WILL BE

YOU

A REFUND FROM THE CITY

WORKED IN, INFORMING THEM THAT YOU RECEIVED

OF SPRINGDALE

ON YOUR MUNICIPAL. TAXES.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1