Form Alt - Alternative T0 1040 - City Of Canfield - 2011

ADVERTISEMENT

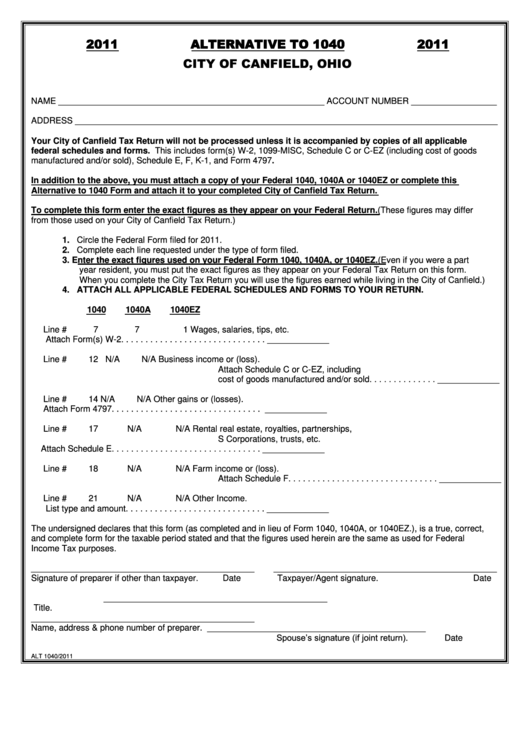

2011

ALTERNATIVE TO 1040

2011

CITY OF CANFIELD, OHIO

NAME ________________________________________________________ ACCOUNT NUMBER __________________

ADDRESS _________________________________________________________________________________________

Your City of Canfield Tax Return will not be processed unless it is accompanied by copies of all applicable

federal schedules and forms. This includes form(s) W-2, 1099-MISC, Schedule C or C-EZ (including cost of goods

manufactured and/or sold), Schedule E, F, K-1, and Form 4797.

In addition to the above, you must attach a copy of your Federal 1040, 1040A or 1040EZ or complete this

Alternative to 1040 Form and attach it to your completed City of Canfield Tax Return.

To complete this form enter the exact figures as they appear on your Federal Return. (These figures may differ

from those used on your City of Canfield Tax Return.)

1. Circle the Federal Form filed for 2011.

2. Complete each line requested under the type of form filed.

3. Enter the exact figures used on your Federal Form 1040, 1040A, or 1040EZ. (Even if you were a part

year resident, you must put the exact figures as they appear on your Federal Tax Return on this form.

When you complete the City Tax Return you will use the figures earned while living in the City of Canfield.)

4. ATTACH ALL APPLICABLE FEDERAL SCHEDULES AND FORMS TO YOUR RETURN.

1040

1040A

1040EZ

Line #

7

7

1

Wages, salaries, tips, etc.

Attach Form(s) W-2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _____________

Line #

12

N/A

N/A

Business income or (loss).

Attach Schedule C or C-EZ, including

cost of goods manufactured and/or sold. . . . . . . . . . . . . . _____________

Line #

14

N/A

N/A

Other gains or (losses).

Attach Form 4797. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _____________

Line #

17

N/A

N/A

Rental real estate, royalties, partnerships,

S Corporations, trusts, etc.

Attach Schedule E. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _____________

Line #

18

N/A

N/A

Farm income or (loss).

Attach Schedule F. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _____________

Line #

21

N/A

N/A

Other Income.

List type and amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . _____________

The undersigned declares that this form (as completed and in lieu of Form 1040, 1040A, or 1040EZ.), is a true, correct,

and complete form for the taxable period stated and that the figures used herein are the same as used for Federal

Income Tax purposes.

_______________________________________________

_______________________________________________

Signature of preparer if other than taxpayer.

Date

Taxpayer/Agent signature.

Date

_______________________________________________

Title.

_______________________________________________

Name, address & phone number of preparer.

______________________________________________

Spouse’s signature (if joint return).

Date

ALT 1040/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1