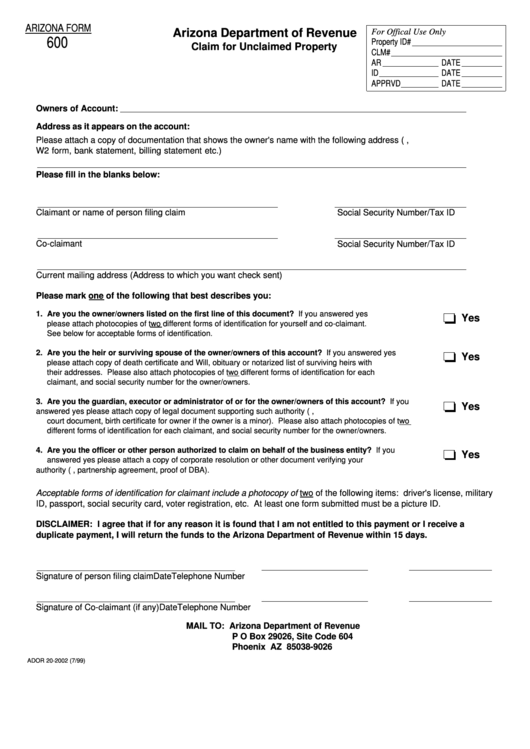

ARIZONA FORM

Arizona Department of Revenue

For Offical Use Only

600

Property ID#

Claim for Unclaimed Property

CLM#

AR

DATE

ID

DATE

APPRVD

DATE

Owners of Account:

Address as it appears on the account:

Please attach a copy of documentation that shows the owner's name with the following address (i.e. tax return,

W2 form, bank statement, billing statement etc.)

Please fill in the blanks below:

Claimant or name of person filing claim

Social Security Number/Tax ID

Co-claimant

Social Security Number/Tax ID

Current mailing address (Address to which you want check sent)

Please mark one of the following that best describes you:

1. Are you the owner/owners listed on the first line of this document? If you answered yes

Yes

please attach photocopies of two different forms of identification for yourself and co-claimant.

See below for acceptable forms of identification.

2. Are you the heir or surviving spouse of the owner/owners of this account? If you answered yes

Yes

please attach copy of death certificate and Will, obituary or notarized list of surviving heirs with

their addresses. Please also attach photocopies of two different forms of identification for each

claimant, and social security number for the owner/owners.

3. Are you the guardian, executor or administrator of or for the owner/owners of this account? If you

Yes

answered yes please attach copy of legal document supporting such authority (i.e. power of attorney,

court document, birth certificate for owner if the owner is a minor). Please also attach photocopies of two

different forms of identification for each claimant, and social security number for the owner/owners.

4. Are you the officer or other person authorized to claim on behalf of the business entity? If you

Yes

answered yes please attach a copy of corporate resolution or other document verifying your

authority (i.e. transaction privilege tax license, partnership agreement, proof of DBA).

Acceptable forms of identification for claimant include a photocopy of two of the following items: driver's license, military

ID, passport, social security card, voter registration, etc. At least one form submitted must be a picture ID.

DISCLAIMER: I agree that if for any reason it is found that I am not entitled to this payment or I receive a

duplicate payment, I will return the funds to the Arizona Department of Revenue within 15 days.

Signature of person filing claim

Telephone Number

Date

Signature of Co-claimant (if any)

Telephone Number

Date

=====================================================================

MAIL TO: Arizona Department of Revenue

P O Box 29026, Site Code 604

Phoenix AZ 85038-9026

ADOR 20-2002 (7/99)

1

1