Print

Reset

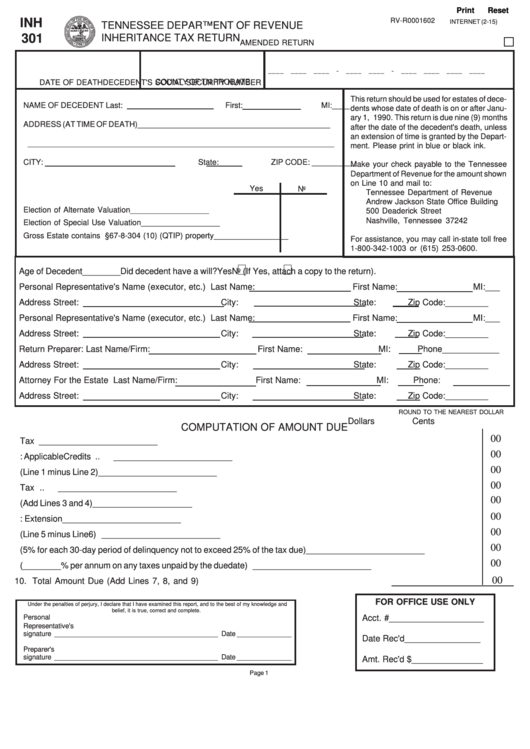

INH

RV-R0001602

INTERNET (2-15)

TENNESSEE DEPARTMENT OF REVENUE

301

INHERITANCE TAX RETURN

AMENDED RETURN

____

____

____

-

____

____

-

____

____

____

____

COUNTY OF TN PROBATE

DATE OF DEATH

DECEDENT'S SOCIAL SECURITY NUMBER

This return should be used for estates of dece-

NAME OF DECEDENT Last:

First:

MI: ____

dents whose date of death is on or after Janu-

ary 1, 1990. This return is due nine (9) months

ADDRESS (AT TIME OF DEATH) ____________________________________________

after the date of the decedent's death, unless

an extension of time is granted by the Depart-

______________________________________________________________________

ment. Please print in blue or black ink.

CITY:

State:

ZIP CODE: __________

Make your check payable to the Tennessee

Department of Revenue for the amount shown

on Line 10 and mail to:

Yes

No

Tennessee Department of Revenue

Andrew Jackson State Office Building

Election of Alternate Valuation

_________

_________

500 Deaderick Street

Nashville, Tennessee 37242

Election of Special Use Valuation

_________

_________

Gross Estate contains T.C.A. §67-8-304 (10) (QTIP) property ________

_________

For assistance, you may call in-state toll free

1-800-342-1003 or (615) 253-0600.

Age of Decedent ________ Did decedent have a will?

Yes

No (If Yes, attach a copy to the return).

Personal Representative's Name (executor, etc.) Last Name:

First Name:

MI: ___

Address Street:

City:

State:

Zip Code: _________

Personal Representative's Name (executor, etc.) Last Name:

First Name:

MI: ___

Address Street:

City:

State:

Zip Code: _________

Return Preparer: Last Name/Firm:

First Name:

MI:

Phone ____________

Address Street:

City:

State:

Zip Code: _________

Attorney For the Estate Last Name/Firm:

First Name:

MI:

Phone:

Address Street:

City:

State:

Zip Code: _________

ROUND TO THE NEAREST DOLLAR

Dollars

Cents

COMPUTATION OF AMOUNT DUE

00

1. Inheritance Tax ......................................................................................................................

_________________________

00

2. Deduct: Applicable Credits .....................................................................................................

_________________________

00

3. Inheritance Tax Payable (Line 1 minus Line 2) .......................................................................

_________________________

00

4. Tennessee Estate Tax ...........................................................................................................

_________________________

00

5. Total Taxes Due (Add Lines 3 and 4) ......................................................................................

_________________________

00

6. Deduct: Extension Payments .................................................................................................

_________________________

00

7. Balance of Tax Due (Line 5 minus Line 6) ..............................................................................

_________________________

00

8. Penalty (5% for each 30-day period of delinquency not to exceed 25% of the tax due) ...........

_________________________

00

9. Interest (________% per annum on any taxes unpaid by the due date) ..................................

_________________________

00

10. Total Amount Due (Add Lines 7, 8, and 9)..........................................................................

FOR OFFICE USE ONLY

Under the penalties of perjury, I declare that I have examined this report, and to the best of my knowledge and

belief, it is true, correct and complete.

Personal

Acct. # ____________________

Representative's

signature __________________________________________ Date ______________

Date Rec'd ________________

Preparer's

signature __________________________________________ Date ______________

Amt. Rec'd $ _______________

Page 1

1

1 2

2 3

3 4

4