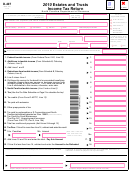

Form D-407 - Estates And Trusts Income Tax Return - 1999 Page 2

ADVERTISEMENT

D-407 Reverse

Schedule A. North Carolina Fiduciary Adjustments (See instructions.)

Additions to Federal Taxable Income

.

00

1.

1. Interest income from obligations of states other than North Carolina

.

00

2. State, local, or foreign income taxes deducted on the federal return

2.

.

00

3. Lump-sum distributions from a qualified pension, profit sharing, or stock bonus plan

3.

.

00

4. Other additions to federal taxable income (See instructions)

4.

.

00

5. Total additions to federal taxable income (Add lines 1 through 4)

5.

Apportion the additions on Line 5 between the beneficiaries and the fiduciary on Schedule B, Line 3 below

Deductions from Federal Taxable Income

.

6. Interest income from obligations of the United States, United States’ possessions, or the State of North Carolina

00

6.

.

7. Taxable portion of Social Security and Railroad Retirement benefits

00

7.

.

8. Federal, state, or local government retirement benefits exclusion

00

8.

(Not to exceed $4,000 - See instructions)

.

00

9.

9. Private retirement benefits exclusion (Not to exceed $2,000)

.

00

10.

10. Add Lines 8 and 9

.

00

11.

11. Enter the amount from Line 10 or $4,000, whichever is less

.

00

12. State, local, or foreign income tax refunds reported as income on federal return

12

.

.

00

13. Other deductions from federal taxable income (See instructions)

13.

.

00

14. Total deductions from federal taxable income (Add Lines 6, 7, 11, 12, and 13)

14.

Apportion the deductions on Line 14 between the beneficiaries and the fiduciary on Schedule B, Line 4 below

Schedule B. Allocation of Adjustments (See instructions.)

Attach other pages

Fiduciary

Beneficiary 1

Beneficiary 2

Beneficiary 3

if needed.

1.

Identifying Number

2.

Name

3.

Additions

4.

Deductions

The information from Schedule B must be furnished to each beneficiary showing the portion of the additions and deductions to be used in filing the beneficiary’s North

Carolina Individual Income Tax Return. The amounts on Lines 3 and 4 should be reported by the beneficiaries as adjustments to federal taxable income.

Tax Rate Schedule

If the amount on Page 1, Line 7

is more than

But not over

The tax is

$12,750

6% of the amount on Line 7

$0

$60,000

$765 + 7% of amount over $12,750

$12,750

- - - -

$4,072.50 + 7.75% of amount over $60,000

$60,000

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than fiduciary, this certification is based on all

information of which the preparer has any knowledge.

Signature of Fiduciary Representing Estate or Trust

Signature of Preparer other than Fiduciary

Date

Date

Telephone Number

Address

MAIL TO: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0645

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2