Form Va-8453 - Virginia Individual Income Tax Declaration For Electronic Filing - 1999

ADVERTISEMENT

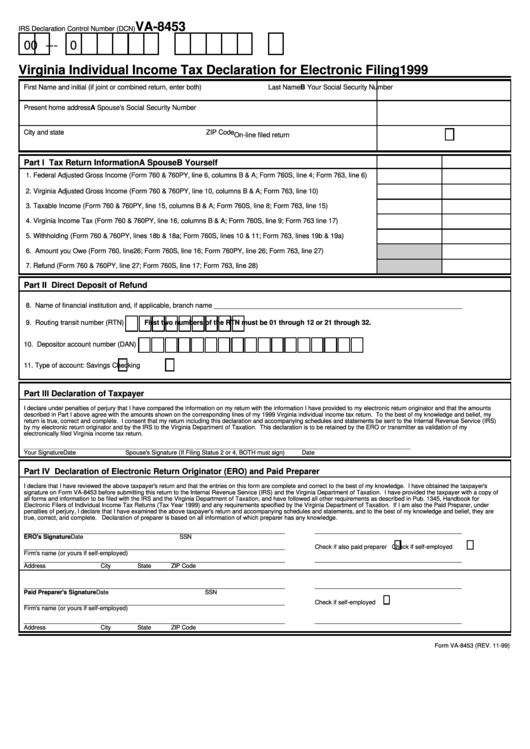

VA-8453

IRS Declaration Control Number (DCN)

0 0 -

-

- 0

Virginia Individual Income Tax Declaration for Electronic Filing

1999

First Name and initial (if joint or combined return, enter both)

Last Name

B Your Social Security Number

Present home address

A Spouse's Social Security Number

City and state

ZIP Code

On-line filed return

Part I Tax Return Information

A Spouse

B Yourself

1. Federal Adjusted Gross Income (Form 760 & 760PY, line 6, columns B & A; Form 760S, line 4; Form 763, line 6)

2. Virginia Adjusted Gross Income (Form 760 & 760PY, line 10, columns B & A; Form 763, line 10)

3. Taxable Income (Form 760 & 760PY, line 15, columns B & A; Form 760S, line 8; Form 763, line 15)

4. Virginia Income Tax (Form 760 & 760PY, line 16, columns B & A; Form 760S, line 9; Form 763 line 17)

5. Withholding (Form 760 & 760PY, lines 18b & 18a; Form 760S, lines 10 & 11; Form 763, lines 19b & 19a)

6. Amount you Owe (Form 760, line26; Form 760S, line 16; Form 760PY, line 26; Form 763, line 27)

7. Refund (Form 760 & 760PY, line 27; Form 760S, line 17; Form 763, line 28)

Part II Direct Deposit of Refund

8. Name of financial institution and, if applicable, branch name _________________________________________________________________

9. Routing transit number (RTN)

First two numbers of the RTN must be 01 through 12 or 21 through 32.

10. Depositor account number (DAN)

11. Type of account:

Savings

Checking

Part III Declaration of Taxpayer

I declare under penalties of perjury that I have compared the information on my return with the information I have provided to my electronic return originator and that the amounts

described in Part I above agree with the amounts shown on the corresponding lines of my 1999 Virginia individual income tax return. To the best of my knowledge and belief, my

return is true, correct and complete. I consent that my return including this declaration and accompanying schedules and statements be sent to the Internal Revenue Service (IRS)

by my electronic return originator and by the IRS to the Virginia Department of Taxation. This declaration is to be retained by the ERO or transmitter as validation of my

electronically filed Virginia income tax return.

____________________________________________________

__________________________________________________________________

Your Signature

Date

Spouse's Signature (If Filing Status 2 or 4, BOTH must sign)

Date

Part IV Declaration of Electronic Return Originator (ERO) and Paid Preparer

I declare that I have reviewed the above taxpayer's return and that the entries on this form are complete and correct to the best of my knowledge. I have obtained the taxpayer's

signature on Form VA-8453 before submitting this return to the Internal Revenue Service (IRS) and the Virginia Department of Taxation. I have provided the taxpayer with a copy of

all forms and information to be filed with the IRS and the Virginia Department of Taxation, and have followed all other requirements as described in Pub. 1345, Handbook for

Electronic Filers of Individual Income Tax Returns (Tax Year 1999) and any requirements specified by the Virginia Department of Taxation. If I am also the Paid Preparer, under

penalties of perjury, I declare that I have examined the above taxpayer's return and accompanying schedules and statements, and to the best of my knowledge and belief, they are

true, correct, and complete. Declaration of preparer is based on all information of which preparer has any knowledge.

________________________________________________________________________________

_____________________________________________

ERO's Signature

Date

SSN

________________________________________________________________________________

Check if also paid preparer

Check if self-employed

Firm's name (or yours if self-employed)

________________________________________________________________________________

_____________________________________________

Address

City

State

ZIP Code

E.I. No.

________________________________________________________________________________

_____________________________________________

Paid Preparer's Signature

Date

SSN

________________________________________________________________________________

Check if self-employed

Firm's name (or yours if self-employed)

________________________________________________________________________________

_____________________________________________

Address

City

State

ZIP Code

E.I. No.

Form VA-8453 (REV. 11-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1